In 2017 my Website was migrated to

the clouds and reduced in size.

Hence some links below are broken.

One thing to try if a “www” link is broken is to substitute “faculty” for “www”

For example a broken link

http://faculty.trinity.edu/rjensen/Pictures.htm

can be changed to corrected link

http://faculty.trinity.edu/rjensen/Pictures.htm

However in some cases files had to be removed to reduce the size of my Website

Contact me at rjensen@trinity.edu if

you really need to file that is missing

Working Paper 440

Annuities With Unequal Compounding and Payment Periods:

The CFA Deconstruction Analysis

Bob Jensen

at Trinity University

Before reading this you may want to peruse my document on the Wolfram Alpha

Computational and Word Search Engine ---

Some Things You Might Want to Know About the Wolfram Alpha (WA) Search

Engine: The Good and The Evil

as Applied to Learning Curves (Cumulative Average vs. Incremental Unit)

http://faculty.trinity.edu/rjensen/theorylearningcurves.htm

The discussion below is not about learning curves, but I will

use the WA search engine.

Financial calculators and Excel financial formulas for computing present

value, interim payments, and rates of return assume that p=m where p is the

number of equally-spaced payments per year and m is the number equally-spaced

interest compoundings per year. Complications introduced by p not being equal to

m are not trivial problems. These complications are overlooked in many

(probably almost all) mathematics of finance modules in both high school and

college courses.

This note will demonstrate how to deal with complications when the number of

payments per year is unequal to the number in times interest is compounded per

year. This is not a purely academic problem. Companies buying and selling

annuities often do not want to change the number of times interest is compounded

every time they change the number of payments per year in a contract such as

semi-annual payments versus quarterly payments versus monthly payments.

The paper was inspired by the following working paper sent to me by an

Australian professor named Chris Deeley. Chris subsequently allowed me to put

his paper on one of my Web servers:

"IDENTIFICATION AND CORRECTION OF A COMMON ERROR IN GENERAL ANNUITY

CALCULATIONS"

by Chris Deeley,

Working Paper, Charles Sturt University, Australia, September 22, 2010

http://www.cs.trinity.edu/~rjensen/temp/DeeleyAnnuityCorrections.pdf

cdeeley@csu.edu.au

For illustrative purposes I will focus on the following example on Page 11 of

Professor Deeley's working paper:

Example 2

A loan of $1million is to be repaid in equal monthly installments over four

years. If the annual interest rate is 10% compounded semi-annually, how much

is the monthly repayment?

The two solutions given by Professor Deeley for p=12 payments per year and

m=2 interest compoundings per year are as follows:

Deeley Solution 1 PMT = $25,265.60 per month which

Professor Deeley claims the "conventional solution"

Deeley Solution 2 PMT = $25,260.70 per month which Professor

Deeley claims is his "proposed better solution"

I contend that there is a CFA Deconstruction and Rate Equivalence solution

that I offer as an "alternate conventional solution" that is used of Certified

Financial Analyst (CFA) examinations.

CFA Deconstruction PMT = $25,483 per month which conforms to David

Frick's solution tutorial

David R. Frick Tutorials provides some outstanding mathematics of finance

tutorials (free) --- http://www.frickcpa.com/

Time Value of Money Tutorials ---

http://www.frickcpa.com/tvom/TVOM_Compound.asp

In particular I will focus on the following David Frick tutorial

Present Value of an Annuity Tutorial ---

http://www.frickcpa.com/tvom/TVOM_PV_Annuity.asp#period

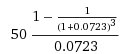

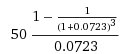

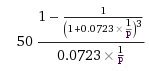

Before beginning my analysis below, I might point out that in his own

illustration, David Frick has a somewhat misleading formula. The formula in

his illustration reads as follows:

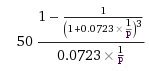

The formula of his illustration should read as follows for p=1 in this

illustration:

The two formulas are equivalent only in the special case where p=1 is the

number of annuity payments per year. In the general case when p>1, the

latter formula would put in the correct m and the two formulas would not be

equivalent.

For illustrative purposes I will focus on the following example on Page 11 of

Professor Deeley's working paper ---

http://www.cs.trinity.edu/~rjensen/temp/DeeleyAnnuityCorrections.pdf

Example 2

A loan of $1million is to be repaid in equal monthly installments over four

years. If the annual interest rate is 10% compounded semi-annually, how much

is the monthly repayment?

|

m=2 interest compoundings per year

|

|

p=12 monthly payments per year |

|

n=48 monthly payments over four years |

|

PV=$1,000,000 present value |

|

i=0.10 annual interest rate in the annuity

contract |

For the CFA Deconstruction solution we compute an equivalent i'

interest rate to use in place of the i=0.10 rate. We get the following:

i' = 0.1025

=(1+0.10/2)^(2) - 1

CFA Deconstruction PMT = $25,483 per month which conforms

to David Frick's solution tutorial

=1000000/((1-(1+0.1025/12)^(-48))/(0.1025/12))

The present value of $1,000,000 can be derived using the equivalent 0.1025

interest rate and $25,482.81 monthly annuity payments:

The Excel file below can be downloaded from

http://www.cs.trinity.edu/~rjensen/temp/Annuity01.xlsx