In 2017 my Website was migrated to

the clouds and reduced in size.

Hence some links below are broken.

One thing to try if a “www” link is broken is to substitute “faculty” for “www”

For example a broken link

http://faculty.trinity.edu/rjensen/Pictures.htm

can be changed to corrected link

http://faculty.trinity.edu/rjensen/Pictures.htm

However in some cases files had to be removed to reduce the size of my Website

Contact me at rjensen@trinity.edu if

you really need to file that is missing

Some Things You Might Want to Know About the Wolfram Alpha

(WA) Search Engine: The Good and The Evil

as Applied to Learning Curves (Cumulative Average vs. Incremental Unit)

Bob Jensen

at

Trinity University

Introduction

Wolfram Alpha (WA) Computational Knowledge Search Engine ---

http://www.wolframalpha.com/

You may enter a search term (such as "cumulative average") in the search box or

a formula (such as "(1000000)(8)^((ln(80/100)/ln(2))"that you want solved.

The search term may be disappointing relative to what you obtain from Google,

Bing, or other search engine.

But the formula solving hardly ever disappoints and may even yield very neat

publishable formulas, an answer, and a bonus graph of the function.

Wolfram Alpha ---

http://en.wikipedia.org/wiki/Wolfram_Alpha

Wolfram Alpha (styled Wolfram|Alpha) is an answer

engine developed by Wolfram Research. It is an online service that answers

factual queries directly by computing the answer from structured data,

rather than providing a list of documents or web pages that might contain

the answer as a search engine would. It was announced in March 2009 by

Stephen Wolfram, and was released to the public on May 15, 2009.[1] It was

voted the greatest computer innovation of 2009 by Popular Science.

Wolfram Alpha for Educators ---

http://www.wolframalpha.com/educators/

One evil of WA is that students may enter complex formulas into the search

box and receive instant answers (and sometimes graphs) without having to learn much of the

analytics that they would otherwise learn by solving formulas in

traditional/iterative process that is often valuable in mathematics lessons.

Although solutions can be obtained from other software such as Excel, WA is more

of a one-step process that takes much of the drudgery and learning process that

comes even with the other software. WA presents problems similar to and well

beyond the issue of whether to allow graphing calculators.

But WA need not be so evil if instructors simply control when and if students

are allowed to use WA, such as by not allowing WA to be used on examinations.

That could motivate students to learn how to solve formulas without the aid of

WA as well as to use WA to early on better understand functions before taking

examinations.

I am awestruck by the good features of WA for ease of computation, preparing

papers for publication, and for better understanding complicated formulas.

Although I knew the general features of WA, this week I seriously used it

when confronted with some formulas I needed to solve.

My SJM Paper

"Reconciliation of Learning Rates Between the Cumulative Average Versus

Incremental Learning Rate Models," by Robert E. Jensen,

Scandinavian Journal of Management, Vol. 7,

No. 2, 1991, 137-142 ---

http://www.cs.trinity.edu/~rjensen/temp/WorkingPaper275.pdf

After nearly 20 years I completely forgot about this paper that I drafted in

1989. In 1989 I did not own a PC. Being an old teacher of FORTRAN and COBAL, I

could've written a main frame computer program to solve the formulas in the SJM

paper, but at the time Trinity University was having troubles with its main frame

computer, and I did not own or use a PC until I purchased a PC in 1990. In 1989

I spent days on an HP memory calculator solving the formulas in Table 1 of the

paper. The problem was not so much solving the formulas as it was iteratively

finding the parameters that equated the cumulative average versus incremental

unit learning models.

Out of the blue on September 14, 2010 I received a message from a very polite

Australian professor named Chris Deeley who challenged the computations in my SJM paper published

in 1991. My initial reaction was that he was probably correct since I'd never

subsequently verified my 1989 HP calculator solutions with any modern software

like Excel. Subsequently, I think I have verified the numbers in the paper by

using Excel. However, just for the heck of it I also verified some of the key

numbers using Wolfram Alpha (WA). I'm truly impressed with some of the things WA

will generate that cannot be generated in Excel.

In my particular circumstances the Goal Seek utility in Excel saved hours of

tedious computations on a calculator ---

http://office.microsoft.com/en-gb/excel-help/about-goal-seek-HP005203894.aspx

It turned out that both Jensen and Deeley computed their

numbers correctly under their different models. Professor Deeley defined a

somewhat different incremental learning rate model. Deeley assumes the I(j,q)

learning rate varies when computing each marginal unit cost whereas

Jensen assumes the I(q) marginal unit cost varies only with the number of units,

q, produced in total and the total variable cost V(q)..

Hence comparing Deeley versus Jensen outcomes is like

comparing apples and oranges, although they do get the same total variable cost.

It's just that the patterns of marginal unit costs differ in arriving at total

variable cost. It came to my great relief that the numbers that I computed on a

calculator in 1989 held up in 2010 under both Excel and Wolfram Alpha.

Consider the following numbers for q=8 units of product and an

incremental learning rate of 80% which means that the u(q) marginal per unit of

product will be 80% each time q is doubled. This 80% learning curve in the

aircraft production industry was shown by

Theodore

Paul Wright to be somewhat like the inexplicable

Moore's Law

is to the cost of computer memory. Both inexplicably hold true under different

circumstances.

Suppose the marginal cost of the first unit

is u(1)=$1,000,000.

Here are examples of three test numbers that I first checked in Excel for

Jensen's 1989 model on Page 140 of the SJM paper:

-0.321928 = i exponent of the

80% learning rate

$512,000

= u(8) marginal cost of Unit 8

$5,345,914 = V(8,80) cumulative variable

cost of the first eight production units (e.g., airplanes)

The WA code formulas that I first used to test these calculations in Wolfram

Alpha are as

follows:

-0.321928 = i = (ln(80/100))/(ln(2)) where ln( ) is

a

natural base e logarithm.

$512,000 = u(8) = 1000000*(8^(( ln(80/100))/(ln(2)))

$5,345,914 = V(8,80)=

(1000000)Sum(j=1,8,j^(ln(80/100)/ln(2))) This WA code did not work in

Excel

Wolfram Alpha Extensions

I derived the three numbers above easily in Excel, although in Excel I simply

computed V(8,80) as the sum of u(1) thru u(8). Now comes the interesting part.

Suppose that I was writing a paper and wanted to publish the three functions

shown above. In code, these functions are very difficult for readers of a paper.

However, when these codes are read into WA all sorts of neat things happen. If I

wanted to publish these results or better explain to students what is being

calculated, I could cut and paste the WA math interpretations generated by the

incomprehensible code.

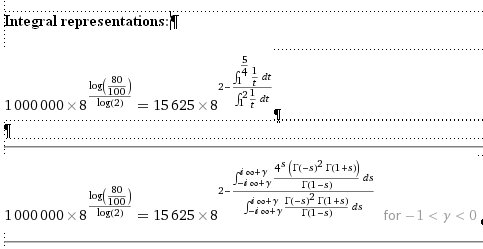

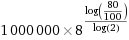

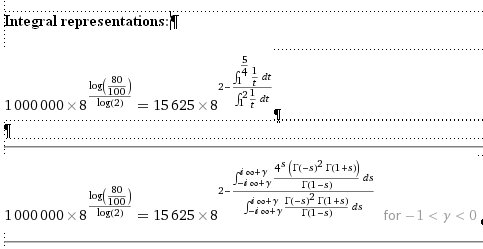

Firstly, I get Wolfram Alpha formatted formulas that I can cut and past into

a paper.

-0.321928 = i =

(ln(80/100))/(ln(2))

=

where log is a natural logarithm

where log is a natural logarithm

$512,000 = u(8) =

1000000*(8^(( ln(80/100))/(ln(2)))

=

where log is a

natural logarithm

where log is a

natural logarithm

$5,345,914 = V(8,80 =

(1000000)Sum(j=1,8,j^(ln(80/100)/ln(2)))

=

where log is a natural logarithm

where log is a natural logarithm

Secondly, I get some added WA information for extending the formulas to the

limit in a continuum:

=

=

Thirdly for some functions, graphs and other information about those

functions will be generated (including regressions and probability distribution

graphs)

http://www.wolframalpha.com/examples/

A few other things to try in Wolfram

Alpha:

Excel Solutions and Extensions of SJM

Paper

"Reconciliation of Learning Rates Between the Cumulative Average Versus

Incremental Learning Rate Models," by Robert E. Jensen,

Scandinavian Journal of Management, Vol. 7,

No. 2, 1991, 137-142 ---

http://www.cs.trinity.edu/~rjensen/temp/WorkingPaper275.pdf

Excel is still more useful than WA for repetitive calculations.

As mentioned above, the huge time saver in this instance is the

Goal Seek utility in Excel.

The Excel verifications of the numbers in my SJM paper and some extensions are

shown below:

|

|

Equivalent C = |

87.43 |

From Goal Seek |

|

Fixed I = |

80 |

|

The 87.43% learning rate agrees with C(80,8) on Page 140 of the paper |

|

|

|

c= |

-0.1938545 |

|

|

|

i= |

-0.321928095 |

|

The i= -0.321928 exponent appears on Page 140 of the paper |

|

|

|

|

u(1)= |

$1,000,000 |

|

|

|

u(1)= |

$1,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

u(8)= |

$545,574 |

|

|

|

u(8)= |

$512,000 |

|

The u(8) = $512,000 cost of the 8th unit agrees with Page 140 of the

paper |

|

|

|

Marginal |

Variable |

Cumulative |

|

Double j |

Marginal |

Variable |

|

Cumulative |

Double j |

|

|

|

|

|

|

|

|

|

Cost |

Cost |

Average |

|

Learning |

Cost |

Cost |

|

Average |

Learning |

|

|

|

|

|

|

|

|

|

u(j) |

V(j) |

v(j) |

|

Rate |

u(j) |

V(j) |

|

v(j) |

Rate |

|

|

|

|

|

|

|

|

|

1000000 |

|

1000000 |

|

|

1000000 |

|

|

1000000 |

|

|

|

|

|

|

|

|

|

1 |

1000000 |

1000000 |

1000000 |

1000000 |

|

1000000 |

1000000 |

|

1000000 |

|

|

|

|

|

|

|

|

|

2 |

748534 |

1748534 |

874267 |

874267 |

0.8743 |

800000 |

1800000 |

|

900000 |

0.8000 |

|

|

|

|

|

|

|

|

3 |

676005 |

2424539 |

808180 |

808180 |

|

702104 |

2502104 |

|

834035 |

|

|

|

|

|

|

|

|

|

4 |

632831 |

3057370 |

764342 |

764342 |

0.8743 |

640000 |

3142104 |

|

785526 |

0.8000 |

|

|

|

|

|

|

|

|

5 |

602550 |

3659920 |

731984 |

731984 |

|

595637 |

3737741 |

|

747548 |

|

|

|

|

|

|

|

|

|

6 |

579468 |

4239388 |

706565 |

706565 |

0.8743 |

561683 |

4299424 |

|

716571 |

0.8000 |

|

|

|

|

|

|

|

|

7 |

560952 |

4800340 |

685763 |

685763 |

|

534490 |

4833914 |

|

690559 |

|

|

|

|

|

|

|

|

|

8 |

545574 |

5345914 |

668239 |

668239 |

0.8743 |

512000 |

5345914 |

|

668239 |

0.8000 |

|

|

|

|

|

|

|

|

V(8)= |

$5,345,914 |

=Sum |

From Goal Seek |

|

$5,345,914 |

=Sum = V(8) |

|

This V(8) total variable cost agrees with Page 140 of the paper |

|

|

|

|

$668,239 |

=Average |

|

|

|

$668,239 |

=Average |

|

This average is incorrectly given as $664,489 on Page 140 of the paper |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fixed C = |

80 |

|

|

|

Equivalent I = |

67.79 |

|

From Goal Seek |

|

|

|

|

|

|

|

|

|

c= |

-0.3219281 |

|

|

|

i= |

-0.560926783 |

|

|

|

|

|

|

|

|

|

|

|

|

u(1)= |

$1,000,000 |

|

|

|

u(1)= |

$1,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

u(8)= |

$354,573 |

|

|

|

u(8)= |

$311,482 |

|

|

|

|

|

|

|

|

|

|

|

|

Marginal |

Variable |

Cumulative |

|

Double j |

Marginal |

Variable |

|

Cumulative |

Double j |

|

|

|

|

|

|

|

|

|

Cost |

Cost |

Average |

|

Learning |

Cost |

Cost |

|

Average |

Learning |

|

|

|

|

|

|

|

|

|

u(j) |

V(j) |

v(j) |

|

Rate |

u(j) |

V(j) |

|

v(j) |

Rate |

|

|

|

|

|

|

|

|

|

1000000 |

|

1000000 |

|

|

1000000 |

|

|

1000000 |

|

|

|

|

|

|

|

|

|

1 |

1000000 |

1000000 |

1000000 |

1000000 |

|

1000000 |

1000000 |

|

1000000 |

|

|

|

|

|

|

|

|

|

2 |

600000 |

1600000 |

800000 |

800000 |

0.8000 |

677867 |

1677867 |

|

838933 |

0.6779 |

|

|

|

|

|

|

|

|

3 |

506311 |

2106311 |

702104 |

702104 |

|

539970 |

2217837 |

|

739279 |

|

|

|

|

|

|

|

|

|

4 |

453689 |

2560000 |

640000 |

640000 |

0.8000 |

459503 |

2677340 |

|

669335 |

0.6779 |

|

|

|

|

|

|

|

|

5 |

418187 |

2978187 |

595637 |

595637 |

|

405442 |

3082782 |

|

616556 |

|

|

|

|

|

|

|

|

|

6 |

391911 |

3370098 |

561683 |

561683 |

0.8000 |

366028 |

3448810 |

|

574802 |

0.6779 |

|

|

|

|

|

|

|

|

7 |

371329 |

3741427 |

534490 |

534490 |

|

335708 |

3784518 |

|

540645 |

|

|

|

|

|

|

|

|

|

8 |

354573 |

4096000 |

512000 |

512000 |

0.8000 |

311482 |

4096000 |

|

512000 |

0.6779 |

|

|

|

|

|

|

|

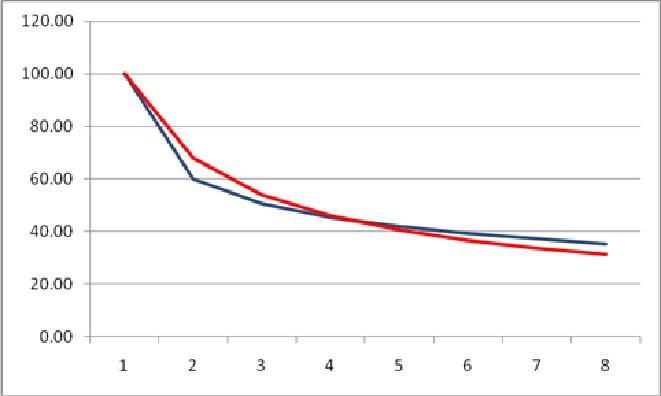

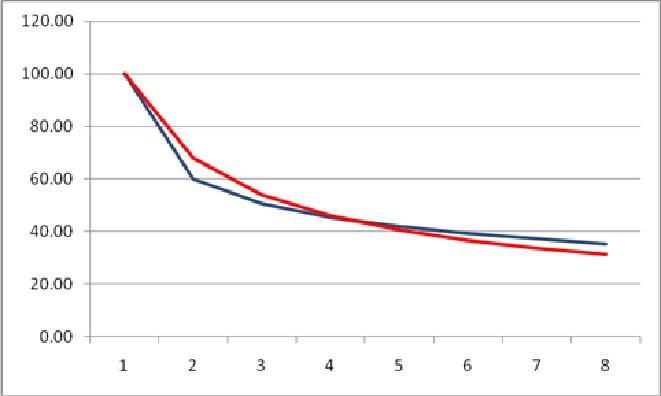

Both models are

fairly close in marginal cost outcomes (Jensen in red, Deeley in blue) for q=8.

They will converge as q increases.

In my opinion, both the Jensen

and Deeley models have a learning rate that is too high between the u(1)

marginal cost of the first unit vis-à-vis the marginal cost u(2) of the second

unit.

Two online spreadsheets are

available at

http://www.cs.trinity.edu/~rjensen/temp/WP275Table02b.xlsx

http://www.cs.trinity.edu/~rjensen/temp/WP275Table03b.xlsx

Having verified the main numbers that appear in the Table 1 of my 1991 SJM

paper, I did find a few corrections.

On Page 138, the c in Equation 3 should've been upper case.

On Page 140, ln (0.80/100) should read ln (80)/100))

On Pages 140 and 141, $664,489 should read $668,239

Updates

September 22, 2010 message from Deeley, Chris

[CDeeley@csu.edu.au]

Bob

I have now

solved the riddle (as you already had) of why our two sets of numbers

differ. Mine bases parity on incremental cost, while your's bases parity on

total cost (and also, of course, cumulative average cost). This point is

made perfectly clear below Table 1 where you refer to “what cumulative

average model learning rate would achieve the same total cost”. I must have

overlooked this earlier and mistakenly assumed that you were trying to

establish parity with respect to incremental cost.

I suggest a

sensible synthesis is to acknowledge that we have closed-form equations for

(1) converting incremental rates into cumulative average rates if parity is

with reference to cumulative average costs, and (2) converting cumulative

average rates into incremental rates if parity is with reference to

incremental costs. That being the case, I don’t see why Table 1 cannot be

constructed on that basis. I assume the main objective of the exercise is to

determine which curve is more realistic (to date) and therefore presumed to

be the more reliable for forecasting purposes. It doesn’t really matter what

the points of parity and comparison are, so long as they are clearly

identified.

Anyway, I’ll

carry on with my table and send you the finished product. I suspect that the

“hybrid” table will not take long to complete.

Chris

Chris Deeley

Senior Lecturer in Accounting & Finance

School of Accounting, Faculty of Business

Charles Sturt University, Locked Mail Bag 588

Wagga Wagga, NSW 2678

Ph: +612 69332694 Fax: +612 69332790

September 23, 2010 message from

Deeley, Chris

[CDeeley@csu.edu.au]

Bob

Thanks for this. I must say I find the material you’ve made available on the

Internet most fascinating, especially the comments on retirement, which is a

key interest of mine. In Australia one cannot be forced to retire because of

age. I’m 66 and not planning to retire anytime soon. I switched out of a

defined benefit pension scheme and into a defined contribution scheme some

time ago, so I have a financial incentive to stay on a payroll. Fortunately

my wife is on an indexed pension, so we have a good safety net.

I’ve now completed my “hybrid” table, which establishes parity between the

two learning curves with respect to (1) cumulative average cost when the

incremental learning rate is held constant, and (2) incremental cost when

the cumulative average learning rate is held constant. This avoids the issue

of non-closed-form algebraic solutions, as mentioned in your SJM article

(although a suitable solution algorithm, if there is one, would overcome

that problem). Unfortunately, I still struggle to compute accumulated costs

from a given incremental learning rate for values of q above 200 (assuming

that we start with q = 1). This explains the question marks in my table,

which you may be able to quantify for me using Wolfram Alpha (if you have

the time and inclination). You’ll see that the equivalency figures in the

left-hand part of my table are identical to yours, which comes as no

surprise after eliminating the apples v oranges element.

Re worthwhile retirement activities: how about reviewing submitted papers

for journals/conferences? Maybe you already do this? I also find trading

shares is a fascinating pastime.

My own research interests are mainly theoretical. It’s amazing how much

stuff is out there which is wrong, but so difficult to change. For example,

I contend that the conventional approach to solving general annuity problems

is invalid when the frequency of payments exceeds the frequency of interest

compounding. I’ll attach a draft paper on this topic, in case it may be of

interest.

I

hope I haven’t taken up too much of your time.

Chris

|

Table II. Reconciliation of incremental &

cumulative average learning curves |

|

|

|

|

|

Incremental learning rate: |

80% |

|

|

|

Cumulative average learning rate: |

80% |

|

|

|

|

Cumulative average learning |

|

|

|

|

Incremental learning |

|

|

|

|

Cumulative |

|

rate |

|

|

Incremental |

|

rate |

|

|

|

|

average cost parity |

varies |

|

|

cost parity |

varies |

|

|

|

q |

U |

CAC |

C % |

U |

CAC |

CAC |

U |

I % |

CAC |

U |

|

1 |

1,000,000 |

1,000,000 |

|

1,000,000 |

1,000,000 |

1,000,000 |

1,000,000 |

|

1,000,000 |

1,000,000 |

|

2 |

800,000 |

900,000 |

90.000 |

800,000 |

900,000 |

800,000 |

600,000 |

60.000 |

800,000 |

600,000 |

|

3 |

702,104 |

834,035 |

89.181 |

718,482 |

834,035 |

702,104 |

506,311 |

65.089 |

719,067 |

506,311 |

|

4 |

640,000 |

785,526 |

88.630 |

664,465 |

785,526 |

640,000 |

453,689 |

67.356 |

665,450 |

453,689 |

|

5 |

595,637 |

747,548 |

88.223 |

624,457 |

747,548 |

595,637 |

418,187 |

68.696 |

625,713 |

418,187 |

|

6 |

561,683 |

716,571 |

87.904 |

592,982 |

716,571 |

561,683 |

391,911 |

69.602 |

594,426 |

391,911 |

|

7 |

534,490 |

690,559 |

87.644 |

567,232 |

690,559 |

534,490 |

371,329 |

70.266 |

568,811 |

371,329 |

|

8 |

512,000 |

668,239 |

87.427 |

545,574 |

668,239 |

512,000 |

354,573 |

70.779 |

547,251 |

354,573 |

|

9 |

492,950 |

648,763 |

87.241 |

526,974 |

648,763 |

492,950 |

340,546 |

71.190 |

528,724 |

340,546 |

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

476,510 |

631,537 |

86.062 |

481,203 |

607,357 |

476,510 |

328,552 |

71.529 |

508,707 |

328,552 |

|

20 |

381,208 |

524,247 |

86.121 |

413,497 |

524,247 |

381,208 |

260,614 |

73.261 |

415,429 |

260,614 |

|

30 |

334,559 |

467,330 |

85.639 |

364,177 |

467,330 |

334,559 |

228,091 |

73.992 |

366,044 |

228,091 |

|

40 |

304,966 |

429,836 |

85.329 |

332,409 |

429,836 |

304,966 |

207,631 |

74.425 |

334,190 |

207,631 |

|

50 |

283,827 |

402,434 |

85.106 |

309,523 |

402,434 |

283,827 |

193,080 |

74.721 |

311,222 |

193,080 |

|

60 |

267,647 |

381,130 |

84.933 |

291,913 |

381,130 |

267,647 |

181,975 |

74.942 |

293,538 |

181,975 |

|

70 |

254,690 |

363,869 |

84.794 |

277,757 |

363,869 |

254,690 |

173,097 |

75.115 |

279,317 |

173,097 |

|

80 |

243,973 |

349,465 |

84.679 |

266,021 |

349,465 |

243,973 |

165,766 |

75.256 |

267,521 |

165,766 |

|

90 |

234,895 |

337,176 |

84.581 |

256,059 |

337,176 |

234,895 |

159,562 |

75.374 |

257,508 |

159,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

227,062 |

326,508 |

84.496 |

247,451 |

326,508 |

227,062 |

154,213 |

75.474 |

248,852 |

154,213 |

|

200 |

181,649 |

263,600 |

83.994 |

197,389 |

263,600 |

181,649 |

123,271 |

76.044 |

198,487 |

123,271 |

|

300 |

159,421 |

232,211 |

83.741 |

172,841 |

232,211 |

159,421 |

108,157 |

76.316 |

? |

108,157 |

|

400 |

145,319 |

212,122 |

83.578 |

157,275 |

212,122 |

145,319 |

98,577 |

76.488 |

? |

98,577 |

|

500 |

135,246 |

197,694 |

83.460 |

146,166 |

197,694 |

135,246 |

91,736 |

76.610 |

? |

91,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1bn* |

1,267 |

? |

? |

? |

? |

1,267 |

859 |

78.967 |

|

859 |

|

* Total costs in $million |

|

|

|

|

|

|

|

|

|

q = units of accumulated prd'n |

U = Incremental unit cost |

CAC = cumulative average cost |

|

|

|

|

|

|

|

|

|

|

|

|

******************

Chris also seen me

his latest working paper on an entirely different topic.

September 23, 2010 message from Chris Deeley

cdeeley@csu.edu.au

Bob

Yes, by all means post my working paper on general annuities on the AECM

website. I suspect that Wolfram Alpha may not be able to handle this sort of

thing. In fact, I wouldn’t be surprised if the application of standard maths has

created and entrenched the error. Chris

Chris Deeley

Senior Lecturer in Accounting & Finance

School of Accounting,

Faculty of Business

Charles Sturt University,

Locked Mail Bag 588

Wagga Wagga, NSW 2678

Ph: +612 69332694 Fax: +612 69332790

Email:

cdeeley@csu.edu.au

Web:

www.csu.edu.au

I put his paper on one of my Web servers. I'm sure that Chris will appreciate

any comments that you have regarding this technical topic. It may be a good

exercise for accounting and finance students to study this paper.

"IDENTIFICATION

AND CORRECTION OF A COMMON ERROR IN GENERAL ANNUITY CALCULATIONS," by Chris

Deeley, Charles Sturt University, Australia., September 23, 2010 Working Draft

---

http://www.cs.trinity.edu/~rjensen/temp/DeeleyAnnuityCorrections.pdf

Chris Deeley in Australia and I have been corresponding regarding an antique

learning curve paper that I published nearly 20 years ago. You can read some of

our correspondence at

http://faculty.trinity.edu/rjensen/theorylearningcurves.htm

In that correspondence I discuss the good and evil of the Wolfram Alpha

computational search engine.

Instructors might want to consider adding this to their teaching modules on

time value of money and annuity mathematics of finance.

Working Paper 440

Annuities With Unequal Compounding and Payment Periods: The

CFA Deconstruction Analysis

Bob Jensen at

Trinity University

Financial calculators and Excel financial formulas for computing present

value, interim payments, and rates of return assume that p=m where p is the

number of equally-spaced payments per year and m is the number equally-spaced

interest compoundings per year. Complications introduced by p not being equal to

m are not trivial problems. These complications are

overlooked in many (probably almost all) mathematics of finance modules in both

high school and college courses.

This note will demonstrate how to deal with complications when the number of

payments per year is unequal to the number in times interest is compounded per

year. This is not a purely academic problem. Companies buying and selling

annuities often do not want to change the number of times interest is compounded

every time they change the number of payments per year in a contract such as

semi-annual payments versus quarterly payments versus monthly payments.

The paper was inspired by the following working paper sent to me by an

Australian professor named Chris Deeley. Chris subsequently allowed me to put

his paper on one of my Web servers:

"IDENTIFICATION AND CORRECTION OF A COMMON ERROR

IN GENERAL ANNUITY CALCULATIONS"

by Chris Deeley

cdeeley@csu.edu.au

Working Paper, Charles Sturt University, Australia, September 22, 2010

http://www.cs.trinity.edu/~rjensen/temp/DeeleyAnnuityCorrections.pdf

For illustrative purposes I will focus on the following example on Page 11 of

Professor Deeley's working paper:

Example 2

A loan of $1million is to be repaid in equal monthly installments over four

years. If the annual interest rate is 10% compounded semi-annually, how much is

the monthly repayment?

The two solutions given by Professor Deeley for p=12 payments per year and

m=2 interest compoundings per year are as follows:

Deeley Solution 1 PMT = $25,265.60 per month which Professor

Deeley claims the "conventional solution"

Deeley Solution 2 PMT = $25,260.70 per month which Professor

Deeley claims is his "proposed better solution"

I contend that there is a CFA Deconstruction and Rate Equivalence solution

that I offer as an "alternate conventional solution" used of Certified Financial

Analyst (CFA) examinations.

CFA Deconstruction PMT = $25,483 per month which conforms to David

Frick's solution tutorial

I show how to calculate this $25,483 using both Wolfram

Alpha and Excel in my Working Paper 440 ---

Bob Jensen's analysis of Annuities With Unequal Compounding and Payment

Periods: The CFA Deconstruction Analysis

http://faculty.trinity.edu/rjensen/TheoryAnnuity01.htm

July 31, 2012 message from David Albrecht

I'm sharing the link to my cost accounting syllabus

for a couple of reasons.

http://profalbrecht.wordpress.com/2012/07/31/my-cost-accounting-syllabus/

First, it shows what leading educators say should be

in a syllabus. Second, I've spent a lot of time making it pleasing to the

eyes.

Dave Albrecht

Hi David,

This is a good start, and I commend you for the effort.

You should add a link to MAAW's great cost accounting modules ---

http://maaw.info/JITMain.htm

For example, one module you might want to add in such a syllabus is "Lean

Accounting" ---

http://maaw.info/JITMain.htm

Personally, I would probably play down 80% learning curves since the early

work on learning curves in airplane manufacturing really don't extrapolate

well to most other industries ---

http://faculty.trinity.edu/rjensen/theorylearningcurves.htm

You can, however, bring in more recent evidence on learning curves.

"Ethanol learning Curve—the Brazilian experience," by José Goldemberga,

Suani Teixeira Coelhob, Plinio Mário Nastaric, Oswaldo Lucond, Biomass and

Bioenergy, Volume 26, Issue 3, March 2004, Pages 301–304

Abstract

Economic competitiveness is a very frequent

argument against renewable energy (RE). This paper demonstrates, through the

Brazilian experience with ethanol, that economies of scale and technological

advances lead to increased competitiveness of this renewable alternative,

reducing the gap with conventional fossil fuels.

Jensen Comment

Unlike corn ethanol, sugar cane ethanol is a viable renewable energy

alternative. Corn ethanol, however, just does not get enough energy out for the

energy going into its refining. Corn ethanol can only survive on the basis of

government subsidies and tariff. If we want ethanol in our fuel, we should shift

to cane sugar ethanol production and importing rather than raise tariff barriers

against cane sugar ethanol imports.

There is quite a lot of learning curve literature in the energy field. For

example, look at

http://www.sciencedirect.com/science/article/pii/S0301421505001795

Abstract

The extent and timing of cost-reducing improvements

in low-carbon energy systems are important sources of uncertainty in future

levels of greenhouse-gas emissions. Models that assess the costs of climate

change mitigation policy, and energy policy in general, rely heavily on

learningcurves to include technology dynamics. Historically, no energy

technology has changed more dramatically than photovoltaics (PV), the cost

of which has declined by a factor of nearly 100 since the 1950s. Which

changes were most important in accounting for the cost reductions that have

occurred over the past three decades? Are these results consistent with the

notion that learning from experience drove technical change? In this paper,

empirical data are assembled to populate a simple model identifying the most

important factors affecting the cost of PV. The results indicate that

learning from experience, the theoretical mechanism used to explain learning

curves, only weakly explains change in the most important factors—plant

size, module efficiency, and the cost of silicon. Ways in which the

consideration of a broader set of influences, such as technical barriers,

industry structure, and characteristics of demand, might be used to inform

energy technology policy are discussed.

![]() where log is a natural logarithm

where log is a natural logarithm![]() where log is a

natural logarithm

where log is a

natural logarithm![]() where log is a natural logarithm

where log is a natural logarithm