Peter, Paul, and

Barney:

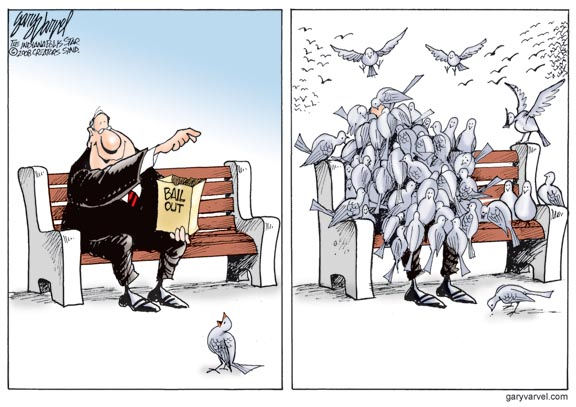

An Evolving Essay On the Hidden Agenda of the U.S. Government Bailout

Bob Jensen at

Trinity Universitys

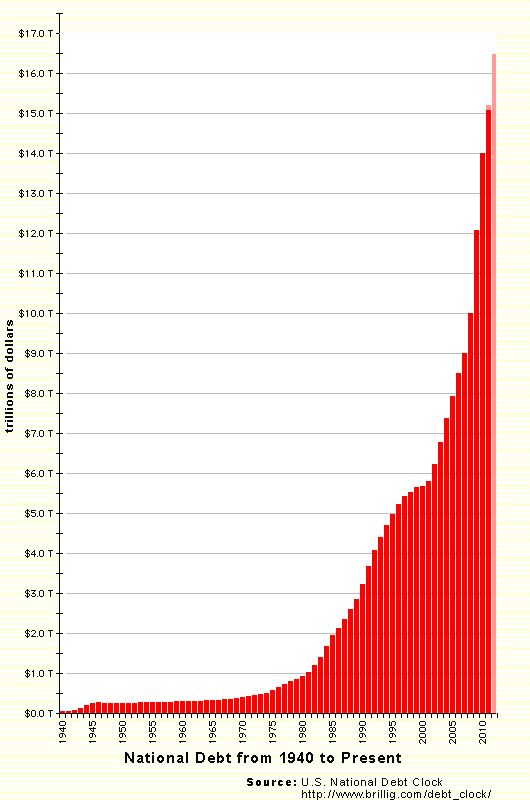

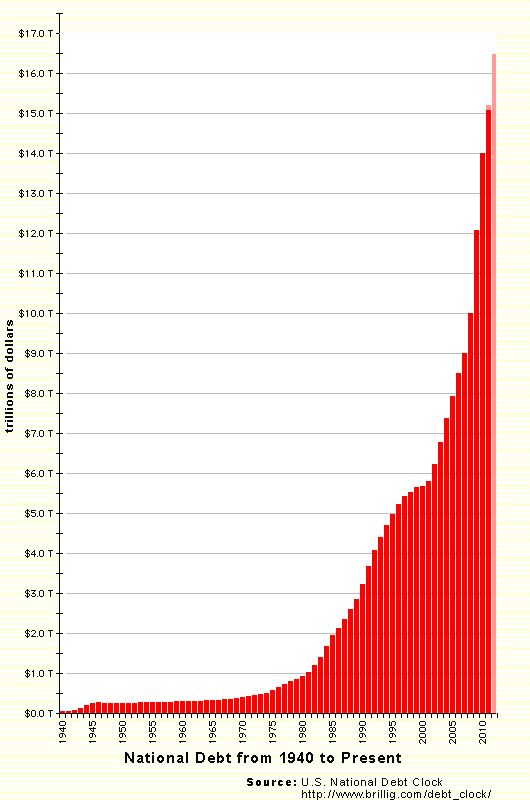

U.S. National Debt Clock ---

http://www.usdebtclock.org/

Also see

http://www.brillig.com/debt_clock/

The unbooked entitlements have a present well over $100 trillion.

But who's counting?

The Real National Debt (booked + unbooked entitlements) 2008

Source ---

http://www.pgpf.org/about/nationaldebt/

American Experience: The Crash of 1929 (Video) ---

http://www.pbs.org/wgbh/amex/crash/

Iowa Sen. Charles Grassley suggested that AIG

executives should accept responsibility for the collapse of the insurance giant

by resigning or killing themselves. The Republican lawmaker's harsh comments

came during an interview Monday with Cedar Rapids, Iowa, radio station WMT . . .

Sen. Charles Grassley wants AIG executives to apologize for the collapse of the

insurance giant — but said Tuesday that "obviously" he didn't really mean that

they should kill themselves. The Iowa Republican raised eyebrows with his

comments Monday that the executives — under fire for passing out big bonuses

even as they were taking a taxpayer bailout — perhaps should "resign or go

commit suicide." But he backtracked Tuesday morning in a conference call with

reporters. He said he would like executives of failed businesses to make a more

formal public apology, as business leaders have done in Japan.

Noel Duara, "Grassley: AIG execs

should repent, not kill selves," Yahoo News, March 17, 2009 ---

http://news.yahoo.com/s/ap/20090317/ap_on_re_us/grassley_aig

From the CFO Journal's Morning Ledger on March 30, 2018

Barclays to pay $2 billion to

resolve securities claims.

Barclays PLC agreed to pay $2

billion in civil penalties to resolve U.S. Justice Department claims that

the U.K. lender fraudulently sold mortgage securities that helped fuel the

financial crisis, causing investors “enormous losses,” the government said

Thursday.

Bob

Jensen's Fraud Updates are at

http://faculty.trinity.edu/rjensen/FraudUpdates.htm

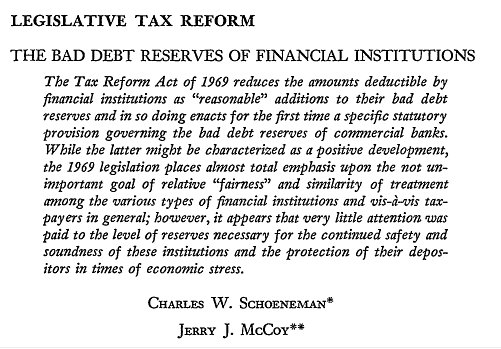

The root cause of the fraud was

the ability of lenders (often felon criminals) to issue mortgages ten or more

times the value of the real estate collateral and then sell those mortgages

upstream to Fannie Mae, Freddie Mack, and Wall Street Banks without bearing any

risk of 1005 certain defaults on those mortgages. These default risks became the

poison of the mortgages later sold in CDO bond portfolios that later brought

down Bear Stearns, Lehman Bros,, Merrill Lynch, etc.

http://faculty.trinity.edu/rjensen/2008Bailout.htm#Sleaze

Video: Is Anyone Minding the Store at the Federal Reserve? ---

http://www.silverbearcafe.com/private/05.09/mindingthestore.html

U.S.

Debt/Deficit Clock ---

http://www.usdebtclock.org/

The Obama Debt Tracker

He added $1.7 trillion of debt in his first year

http://www.treasurydirect.gov/NP/BPDLogin?application=np

Video of Detroit in Ruins ---

http://www.youtube.com/watch?v=1hhJ_49leBw

Video: Steve Wynn Takes On Washington ---

http://www.infowars.com/steve-wynn-takes-on-washington/

Debate Assignment: Should We

Never Pay Down the National Deficit or Debt (even partly)?

http://www.cs.trinity.edu/~rjensen/temp/NationalDeficit-Debt.htm

A Pissing Contest Between Bob and Jagdish: An Illustration of How to Lie

With Statistics ---

http://www.cs.trinity.edu/~rjensen/temp/LieWithStatistics01.htm

"Why Are Some Sectors (Ahem, Finance) So Scandal-Plagued?" by Ben W.

Heineman, Jr., Harvard Business Review Blog, January 10, 2013 ---

Click Here

http://blogs.hbr.org/cs/2013/01/scandals_plague_sectors_not_ju.html?referral=00563&cm_mmc=email-_-newsletter-_-daily_alert-_-alert_date&utm_source=newsletter_daily_alert&utm_medium=email&utm_campaign=alert_date

Greatest Swindle in the History of the World ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#Bailout

The trouble with crony capitalism isn't capitalism. It's the cronies ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#CronyCapitalism

Subprime: Borne of Greed, Sleaze, Bribery, and Lies (including the credit

rating agencies) ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#Sleaze

History of

Fraud in America ---

http://faculty.trinity.edu/rjensen/415wp/AmericanHistoryOfFraud.htm

Bob Jensen's Fraud Updates are at

http://faculty.trinity.edu/rjensen/FraudUpdates.htm

Mortgage Fraud Task Force Stats: Did You See This? WOW ---

http://www.senseoncents.com/2013/08/mortgage-fraud-task-force-stats-did-you-see-this-wow/

Inside Job: 2010 Oscar-Winning Documentary Now Online ---

Click Here

http://www.openculture.com/2011/04/inside_job.html?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+OpenCulture+%28Open+Culture%29

In late February, Charles Ferguson’s film – Inside

Job – won the Academy Award for Best Documentary. And now the film

documenting the causes of the 2008 global financial meltdown has made its

way online (thanks to the Internet Archive). A corrupt financial industry,

its corrosive relationship with politicians, academics and regulators, and

the trillions of damage done, it all gets documented in this film that runs

a little shy of 2 hours.

To watch the film, you will need to do the

following. 1.) Look at the bottom of the film. 2.) Click the forward button

twice so that it moves beyond the initial trailer and the Academy Awards

ceremony. 3.) Wait for the little circle to stop spinning. And 4.) click

play to watch film.

Inside Job (now listed in our Free Movie

Collection) can be purchased on DVD at Amazon. We all love free, but let’s

remember that good projects cost real money to develop, and they could use

real financial support. So please consider buying a copy.

Hopefully watching or buying this film won’t be a

pointless act, even though it can rightly feel that way. As Charles Ferguson

reminded us during his Oscar acceptance speech, we are three years beyond

the Wall Street crisis and taxpayers (you) got fleeced for billions. But

still not one Wall Street exec is facing criminal charges. Welcome to your

plutocracy…

Bob Jensen's threads on the global financial meltdown and its aftershocks

are at

http://faculty.trinity.edu/rjensen/2008Bailout.htm

Wharton: Not Too Big To

Fail: Why Lehman Had to Go Bankrupt ---

http://knowledge.wharton.upenn.edu/article/the-good-reasons-why-lehman-failed/

Essay

Appendix A: Pending Disaster in the U.S.

Appendix B: The Trillion

Dollar Bet in 1993

Appendix C: Don't Blame Fair Value Accounting Standards

(except in terms of executive bonus payments)

This includes a bull crap case based on an article by the former head of the

FDIC

Appendix D: The

End of Capitalism, Economics, and Investment Banking as We Know It

Appendix E: Greatest Swindle

in the History of the World

Your Money at

Work, Fixing Others’ Mistakes (includes a great NPR public radio audio module)

Appendix F: Christopher Cox Waits Until Now

to Tell Us His Horse Was Lame All Along

S.E.C. Concedes Oversight Flaws Fueled Collapse

And This is the Man Who Wants Accounting Standards to Have Fewer Rules

Appendix G: Why

the Trillion-Dollar Bankster Bailout Won't Work

Appendix H: Where were the auditors?

The aftermath will leave the large auditing firms in a precarious state?

Appendix I: 1999 Quote

from The New York Times

''If they fail, the government will have to step up and bail them out the way it

stepped up and bailed out the thrift industry.''

Appendix J: Will the large auditing

firms survive the 2008 banking meltdown?

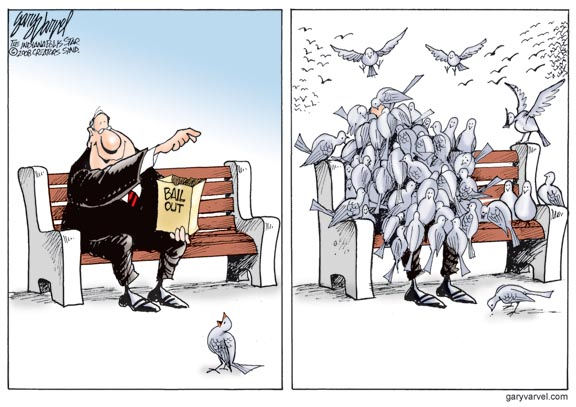

Appendix K: Why not

bail out everybody and everything?

Appendix L: The

trouble with crony capitalism isn't capitalism. It's the cronies.

Appendix M: Reinventing

the American Dream

Appendix N:

Accounting Fraud at Fannie Mae

Appendix O: If Greenspan Caused

the Subprime Real Estate Bubble, Who Caused the Second Bubble That's About to

Burst?

Harvard Professors Says Economists are a Huge Part of the Problem

Appendix P: Meanwhile

in the U.K., the Government Protects Reckless Bankers

Appendix Q: Bob Jensen's Primer on Derivatives

(with great videos from CBS)

Appendix R: Accounting Standard Setters Bending to Industry and

Government Pressure to Hide the Value of Dogs

Appendix S: Fooling

Some People All the Time

Appendix T: Regulations

Recommendations

Appendix U: Subprime:

Borne of Greed, Sleaze, Bribery, and Lies (including the credit rating agencies)

Appendix V: Implications for Educators,

Colleges, and Students

Appendix W: The End

Appendix X: How

Scientists Help Cause Our Financial Crisis

Appendix Y: The

Bailout's Hidden Agenda Details

Appendix Z: What's

the rush to re-inflate the stock market?

The Commission's Final Report ---

http://c0182732.cdn1.cloudfiles.rackspacecloud.com/fcic_final_report_full.pdf

American History of Fraud and White Collar Crime ---

http://faculty.trinity.edu/rjensen/415wp/AmericanHistoryOfFraud.htm

"The Financial Crisis, From A-Z," by Tunku Varadarajan, Forbes,

November 10, 2008 ---

http://www.forbes.com/opinions/2008/11/09/financial-crisis-tarp-oped-cx_tv_1110varadarajan.html

Jensen Comment

This is a clever use of the alphabet and an understanding of what happened.

Shielding Against Validity Challenges in Plato's Cave ---

http://faculty.trinity.edu/rjensen/TheoryTAR.htm

-

With a Rejoinder from the 2010 Senior Editor of The Accounting Review

(TAR), Steven J. Kachelmeier

- With Replies in Appendix 4 to Professor Kachemeier by Professors

Jagdish Gangolly and Paul Williams

- With Added Conjectures in Appendix 1 as to Why the Profession of

Accountancy Ignores TAR

- With Suggestions in Appendix 2 for Incorporating Accounting Research

into Undergraduate Accounting Courses

What went wrong in accounting/accountics research?

---

http://faculty.trinity.edu/rjensen/theory01.htm#WhatWentWrong

The Sad State of Accountancy Doctoral

Programs That Do Not Appeal to Most Accountants ---

http://faculty.trinity.edu/rjensen/theory01.htm#DoctoralPrograms

AN ANALYSIS OF THE EVOLUTION OF RESEARCH

CONTRIBUTIONS BY THE ACCOUNTING REVIEW: 1926-2005 ---

http://faculty.trinity.edu/rjensen/395wpTAR/Web/TAR395wp.htm#_msocom_1

Bob Jensen's threads on accounting theory

---

http://faculty.trinity.edu/rjensen/theory01.htm

Tom Lehrer on Mathematical Models and

Statistics ---

http://www.youtube.com/watch?v=gfZWyUXn3So

Systemic problems of accountancy (especially the

vegetable nutrition paradox) that probably will never be solved ---

http://faculty.trinity.edu/rjensen/FraudConclusion.htm#BadNews

The Financial Crisis Cost Every American $70,000, Fed Study Says ---

Click Here

Jensen Comment

The root causes were as follows:

1. A nationwide super bubble of real estate prices

that inspired buyers speculate in real estate (land and buildings) financed

with subprime mortgages. Buyers intended to turn the properties over before

subprime rates on mortgages gave way to higher rates --- Z

https://en.wikipedia.org/wiki/Subprime_lending

2. Fraud entered into real estate and mortgage lending every step of the

way. The major catalyst was government policy of buying mortgages (think

Fanny Mae and Freddie Mack) with zero percent of the default risk borne by

issuers of mortgages. Many fraudsters started issuing mortgages way above

property values. For example, a criminal lender in Phoenix issued a mortgage

for over $100,000 to a woman on welfare who purchased a shack for $3,500.

Greedy real estate appraisers went wild in overvaluing properties for

fraudulent lenders and buyers. The government and Wall Street investment

bank bought up hundreds of billions of dollars in

poisoned

mortgages (where buyers had no hope of paying off the debt).

3. The Wall Street investment banks (like Lehman Bros. and Merrill Lynch)

who realized they were holding huge amounts of poisoned mortgages tried to

diversify the risk by including them in portfolios of solid mortgages. These

portfolios were then sold as

collateralized debt obligation (CDO) bonds to buyers such as Saudi

Arabia. But the CDO bonds were sold with recourse such that when the USA

real estate bubble burst those investment banks did not have enough

liquidity to buy the CDO bonds back. Then came the government bailout in

which some banks (think Goldman) were bailed out by the government and some

were forced into bankruptcy (think Lehman Bros.) While all of this was going

ton deeply troubled banks were getting fraudulent AAA credit ratings from

greedy credit raters (think Moodys).

What happened before, during, and after the 2008

government bailout is explained in much detail at

http://faculty.trinity.edu/rjensen/2008Bailout.htm

The Financial Crisis Cost Every American $70,000, Fed Study Says ---

Click Here

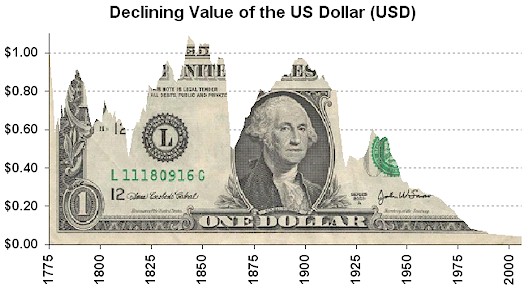

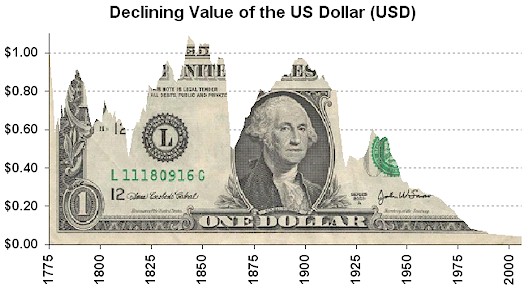

A New Definition of Life on the Edge

Loss of dollar purchasing power since 1775 ---

http://manualofideas.com/blog/2009/03/declining_value_of_us_dollar_s.html

Peter Schiff

is a widely-known economist who predicted the financial crisis well ahead of

most everybody, but nobody listened when he blared out warnings throughout

the media, some of which are on YouTube

No, the main issue with Schiff seems to be that he

hasn't changed his tune (in 2009) --- and it

isn't a pleasant tune to listen to. He thinks the "phony economy" of the U.S. is

headed for even harder times. He believes that the crisis-fighting measures

coming out of Washington are merely delaying the inevitable, debasing the dollar

and loading future taxpayers with huge debts.

Justin Fox, "Excluding the

Extremist: Peter Schiff predicted the credit collapse long before the

'experts." So why is it so hard to hear him now," Time Magazine, June 1,

2009, Page 48.

Barney Frank: I've destroyed the economy, my work

here is done.

Washington Times headline, Nov. 29, 2011

Barney's Rubble ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm#Rubble

Oh, and don't forget Fannie Mae and Freddie Mac,

those two government-sponsored mortgage giants that engineered the 2008 subprime

mortgage fiasco and are now on the public dole. The Fed kept them afloat by

buying over a trillion dollars of their paper. Now, part of the Treasury's

borrowing from the public covers their continuing large losses.

George Melloan, "Hard Knocks From Easy

Money: The Federal Reserve is feeding big government and harming

middle-class savers," The Wall Street Journal, July 6, 2010 ---

http://online.wsj.com/article/SB10001424052748704103904575337282033232118.html?mod=djemEditorialPage_t

"Did Harvard (and then President Larry Summers) Ignore Warnings on

Harvard's Investments?" Inside Higher Ed, November 29, 2009 ---

http://www.insidehighered.com/news/2009/11/30/qt#214304

Senior Harvard University

officials -- especially then-president Lawrence Summers -- repeatedly ignored

warnings that the university's investment strategies were placing far too much

cash (needed for short-term spending) in risky investments,

The Boston Globe reported. The placement of

the cash in risky investments has been a key reason why Harvard, which even

after investment losses is by far the wealthiest university in the world, has

been forced to make many cuts in the last year; such cash reserves, had the

advice been followed, would have been easily accessible. Summers declined to

comment for the article, but a friend of his familiar with the Harvard

investment strategy noted that conditions changed after Summers left the

presidency and that the university had the time to change its strategy prior to

last year's Wall Street collapse.

Jensen Comment

There were advanced warnings before the fall, especially those of Peter Schiff

---

http://en.wikipedia.org/wiki/Peter_Schiff

But he missed the early timing and thus is still not a billionaire.

Larry Summers resigned from Harvard in a clash with feminists and is now the

chief economic advisor to President Obama.

Wave Goodbye to this nation's top

economic advisor

"Lawrence Summers Will Leave White House Post and Return to Harvard,"

Chronicle of Higher Education, September 21, 2010 ---

http://chronicle.com/blogPost/Lawrence-Summers-Will-Leave/27092/

An entire generation's prosperity vanishing, food

stamp use exploding. Welcome to the jobless future. This month's jobs numbers

drive home the point. The unemployment rate fell at the fastest rate for years —

great news, right? Wrong. The vast majority of the gains — 75% — came from (wait

for it) "temporary help services." See what just happened? We subtracted

thousands of real jobs — and replaced them with low-value, no-future McJobs

instead.

"Solve America's Employment Crisis With a Netflix Prize," Harvard

Business School, December 4, 2009 ---

http://blogs.harvardbusiness.org/haque/2009/12/solve_americas_employment_cris.html?cm_mmc=npv-_-DAILY_ALERT-_-AWEBER-_-DATE

"Why I don’t like Larry Summers," by Massimo Pigliucci, Rationally

Speaking, July 22, 2011 ---

http://rationallyspeaking.blogspot.com/2011/07/why-i-dont-like-larry-summers.html

I have to admit to a profound

dislike for former Harvard President and former Obama (and Clinton)

advisor Larry Summers. Besides the fact that, at least going by a number

of reports of people who have known him, he can only be characterized as

a dick, he represents precisely what is wrong with a particularly

popular mode of thinking in this country and, increasingly, in the rest

of the world.

Lawrence was famously forced to resign as

president of Harvard in 2006 because of a no-confidence vote by the

faculty (wait, academics still have any say in how universities are run?

Who knew) because of a variety of reasons, including his conflict with

academic star Cornel West, financial conflict of interests regarding his

dealings with economist Andrei Shleifer, and particularly his remarks to

the effect that perhaps the scarcity of women in science and engineering

is the result of innate intellectual differences (for a critical

analysis of that particular episode see Cornelia Fine’s

Delusions of Gender and the

corresponding

Rationally Speaking podcast).

Now I have acquired yet another reason to dislike

Summers, while reading Debra Satz’s

Why Some Things Should not Be for Sale:

The Moral Limits of Markets,

which I highly recommend to my libertarian friends, as much as I realize

of course that it will be entirely wasted on them. The book is a

historical and philosophical analysis of ideas about markets, and makes

a very compelling case for why thinking that “the markets will take care

of it” where “it” is pretty much anything of interest to human beings is

downright idiotic (as well as profoundly unethical).

But I’m not concerned here with Satz’s book per

se, as much as with the instance in which she discusses for her

purposes, a memo written by Summers when he was chief economist of the

World Bank (side note to people who still don’t think we are in a

plutocracy: please simply make the effort to track Summers’ career and

his influence as an example, or check

this short video by one of my favorite

philosophers, George Carlin). The memo was intended for internal WB use

only, but it caused a public uproar when the, surely not left-wing,

magazine The Economist leaked it to the public. Here is an

extract from the memo (emphasis mine):

“Just between you and me, shouldn’t

the World Bank be encouraging more migration of the dirty industries to

the less developed countries? I can think of three reasons:

1. The measurement of the costs of

health-impairing pollution depends on the foregone earnings from

increased morbidity and mortality. From this point of view a given

amount of health-impairing pollution should be done in the country with

the lowest cost, which will be the country with the lowest wages. I

think the economic logic behind dumping a load of toxic waste in the

lowest wage country is impeccable and we should face up to that.

2. The costs of pollution are

likely to be non-linear as the initial increments of pollution probably

have very low cost ... Only the lamentable facts that so much pollution

is generated by non-tradable industries (transport, electrical

generation) and that the unit transport costs of solid waste are so high

prevent world-welfare enhancing trade in air pollution and waste.

3. The demand for a clean

environment for aesthetic and health reasons is likely to have very high

income elasticity ... Clearly trade in goods that embody aesthetic

pollution concerns could be welfare enhancing.

The problem with the arguments

against all of these proposals for more pollution in least developed

countries (intrinsic rights to certain goods, social concerns, lack of

adequate markets, etc.) could be turned around and used more or less

effectively against every Bank proposal for liberalization.”

Now, pause for a minute, go back to

the top of the memo, and read it again. I suggest that if you find

nothing disturbing about it, your empathic circuitry needs a major

overhaul or at the very least a serious tuneup. But it’s interesting to

consider why.

As both The Economist (who

called the memo “crass”) and Satz herself note, the economic logic of

the memo is indeed impeccable. If one’s only considerations are economic

in nature, it does make perfect sense for less developed countries to

accept (for a — probably low — price) the waste generated by richer

countries, for which in turn it makes perfect sense to pay a price to

literally get rid of their shit.

And yet, as I mentioned, the leaking of the memo

was accompanied by an outcry similar to the one generated by the equally

infamous “Ford

Pinto memo” back in 1968. Why? Here I

actually have a take that is somewhat different from, though

complementary to, that of Satz. For her, there are three ethical

objections that can be raised to the memo: first, she maintains that

there is unequal vulnerability of the parties involved in the bargain.

That is, the poor countries are in a position of marked disadvantage and

are easy for the rich ones to exploit. Second, the less developed

countries likely suffer from what she calls weak agency, since they tend

to be run by corrupt governments whose actions are not in the interest

of the population at large (whether the latter isn’t also true of

American plutocracy is, of course, a matter worth pondering). Third, the

bargain is likely to result in an unacceptable degree of harm to a

number of individuals (living in the poor countries) who are not going

to simultaneously enjoy any of the profits generated from the

“exchange.”

Continued in article

Video: Peter Schiff was right 2006-2007 (CNBC edition) ---

http://www.youtube.com/watch?v=Z0YTY5TWtmU

Five Speaker Videos from the Stanford

Graduate School of Business (on the economic crisis and leadership) [Scroll

Down]

Top 5 Speaker Videos for 2009 ---

http://www.gsb.stanford.edu/news/top-videos.html?cmpid=alumni&source=gsbtoday

"The dominant public policy

imperative motivating reform is to address the moral hazard risk created by what

we did, what we had to do in the crisis to save the economy," Treasury Secretary

Timothy F. Geithner said in an interview. That's from today's Washington Post.

The "moral hazard risk" arises when government encourages people to gamble by

suggesting that government will rescue them if they fail. By bailing out the

banks, the federal government has essentially declared to the world that they

will do it again. That created a moral hazard. It's refreshing to know that

Administration is aware of...

John Stossel, "Geithner Moral

Hazard," ABC News, August 28, 2009 ---

http://blogs.abcnews.com/johnstossel/2009/08/geithner-moral-hazard.html

Ten (now eleven) Trillion and Counting

(a full-length PBS Frontline video) ---

http://www.pbs.org/wgbh/pages/frontline/tentrillion/view/

All of the federal government's efforts to

stem the tide of the financial meltdown have added hundreds of billions of

dollars to an already staggering national debt, a sum that is expected to double

over the next 10 years to more than $23 trillion. In Ten Trillion and Counting,

FRONTLINE traces the politics behind this mounting debt and investigates what

some say is a looming crisis that makes the current financial situation pale in

comparison

This

is a great learning resource: Very Effective

Visual Guide to the Federal Reserve," Simoleon Sense, May 22, 2009 ---

http://www.simoleonsense.com/

Jensen Comment

The Fed's easy credit and low-interest policies of the past two decades got us

into this financial crisis, and the Fed's approach to getting us out of this

mess is like putting gasoline on political fire.

I’d

been working for the bank for about five weeks when I woke up on the balcony of

a ski resort in the Swiss Alps. It was midnight and I was drunk. One of my

fellow management trainees was urinating onto the skylight of the lobby below

us; another was hurling wine glasses into the courtyard. Behind us, someone had

stolen the hotel’s shoe-polishing machine and carried it into the room; there

were a line of drunken bankers waiting to use it. Half of them were dripping

wet, having gone swimming in all their clothes and been too drunk to remember to

take them off. It took several more weeks of this before the bank considered us

properly trained. . . . By the time I arrived on Wall Street in 1999, the link

between derivatives and the real world had broken down. Instead of being used to

reduce risk, 95 per cent of their use was speculation - a polite term for

gambling. And leveraging - which means taking a large amount of risk for a small

amount of money. So while derivatives, and the financial industry more broadly,

had started out serving industry, by the late 1990s the situation had reversed.

The Market had become a near-religious force in our culture; industry, society,

and politicians all bowed down to it. It was pretty clear what The Market didn’t

like. It didn’t like being closely watched. It didn’t like rules that governed

its behaviour. It didn’t like goods produced in First-World countries or workers

who made high wages, with the notable exception of financial sector employees.

This last point bothered me especially.

Philipp Meyer,

American Rust (Simon & Schuster, 2009) ---

http://search.barnesandnoble.com/American-Rust/Philipp-Meyer/e/9780385527514/?itm=1

American excess: A Wall Street trader tells all - Americas, World - The

Independent

http://www.independent.co.uk/news/world/americas/american-excess--a-wall-street-trader-tells-all-1674614.html

Jensen Comment

This book reads pretty much like an update on the derivatives scandals featured

by Frank Partnoy covering the Roaring 1990s before the dot.com scandals broke.

There were of course other insiders writing about these scandals as well ---

http://faculty.trinity.edu/rjensen/FraudRotten.htm#DerivativesFrauds

It would seem that bankers and investment bankers do not learn from their own

mistake. The main cause of the scandals is always pay for performance schemes

run amuck.

A growing concern for Fed policy

makers is a weakening in the US dollar against major currencies. The price of

the euro in US-dollar terms climbed from a low of $1.27 in November last year to

around $1.41 in May and $1.43 in early June — an increase of 12.6% from

November. The major currencies dollar index fell to 78.89 in May from 82.3 in

April — a fall of 4.1%. If the declining trend in the US dollar were to

consolidate, this could cause foreign holders of US-dollar assets to divest into

non-dollar-denominated assets and precious metals.

Frank Shostak, "The Fed Might Have

Painted Itself into a Corner," Mises Institute, June 12, 2009 ---

http://mises.org/story/3518

Let me conclude with a political note. The main reason for

reform is to serve the nation. If we don’t get major financial reform now, we’re

laying the foundations for the next crisis. But there are also political reasons

to act. For there’s a populist rage building in this country, and President

Obama’s kid-gloves treatment of the bankers has put Democrats on the wrong side

of this rage. If Congressional Democrats don’t take a tough line with the banks

in the months ahead, they will pay a big price in November.

Paul Krugman, Bubbles and

the Banks," The New York Times, January 7, 2010 ---

http://www.nytimes.com/2010/01/08/opinion/08krugman.html?hpw

Teaching Case from The Wall Street Journal Accounting Weekly Review on

October 5, 2012

BofA Takes New Crisis-Era Hit

by:

Dan Fitzpatrick, Christian Berthelsen and Robin Sidel

Sep 29, 2012

Click here to view the full article on WSJ.com

Click here to view the

video on WSJ.com ![WSJ Video]()

TOPICS: Contingent Liabilities

SUMMARY: "Bank of America Corp. agreed to pay $2.43 billion to

settle claims it misled investors about the acquisition of troubled

brokerage firm Merrill Lynch & Co...." during the financial crisis in 2008.

At the time it acquired Merrill Lynch in September 2008, BofA became the

biggest U.S. bank; the value of the bank then fell by more than half by the

time the acquisition of Merrill Lynch closed 3 months later. These losses

were not disclosed by then CEO Ken Lewis and his management team to

shareholders before they voted on the merger transaction with Merrill.

CLASSROOM APPLICATION: The article addresses accounting for

litigation contingent liabilities. The related video clearly discusses the

history of the transactions.

QUESTIONS:

1. (Introductory) To whom did Bank of America Corp. (BofA) agree to

pay $2.43 billion dollars?

2. (Introductory) For what losses did BofA agree to make this

payment?

3. (Advanced) How could losses have occurred and a payment of $2.4

billion be required if "Bank of America executives now say Merrill...has

become a big profit contributor... [and that] it's clear that Merrill is a

significant positive any way you want to look at it..."?

4. (Advanced) What accounting standards provide the requirements to

account for costs such as this $2.4 billion payment by BofA?

5. (Advanced) According to the article, BofA has "set aside more

than $42 billion in litigation expenses, payouts and reserves...[which]

includes $1.6 billion taken in the third quarter [of 2012]...." According to

the related video, what period will be affected by $1.6 billion being

recorded as an expense related to this $2.43 billion settlement? Explain

your answer.

Reviewed By: Judy Beckman, University of Rhode Island

RELATED ARTICLES:

BofA-Merrill: Still A Bottom-Line Success

by David Benoit

Sep 28, 2012

Online Exclusive

"BofA Takes New Crisis-Era Hit," by Dan Fitzpatrick, Christian Berthelsen and

Robin Sidel, The Wall Street Journal, September 29, 2012 ---

http://professional.wsj.com/article/SB10000872396390443843904578024110468736042.html?mod=djem_jiewr_AC_domainid&mg=reno-wsj

Bank of America Corp. agreed to pay $2.43 billion

to settle claims it misled investors about the acquisition of troubled

brokerage firm Merrill Lynch & Co., in the latest financial-crisis

aftershock to rattle the banking sector.

The payment is the largest settlement of a

shareholder claim by a financial-services firm since the upheaval of 2008

and 2009. It also ranks as the eighth-largest securities class-action

settlement, behind payouts like the $7.2 billion settlement with

shareholders of Enron Corp. and the $6.1 billion pact with WorldCom Inc.

investors, both in 2005.

The deal is a sign that U.S. banks' battle to

contain the high cost of the crisis continues to escalate, despite a

four-year slog of lawsuits, losses and profit-sapping regulations. Bank of

America's total exposure to crisis-era litigation is "seemingly

never-ending," said Sterne Agee & Leach Inc. in a note Friday.

Is the era that produced all of this legal exposure

"history?" the Sterne Agee & Leach analysts said. "Unlikely."

The settlement ends a three-year fight with a group

of five plaintiffs, including the State Teachers Retirement System of Ohio

and the Teacher Retirement System of Texas. They accused the bank and its

officers of making false or misleading statements about the health of Bank

of America and Merrill Lynch and were planning to seek $20 billion if the

case went to trial as scheduled on Oct. 22.The size of the pact highlights

how hasty acquisitions engineered during the height of the financial crisis

by Kenneth Lewis, then the bank's chief executive, are still haunting the

company four years later. Decisions to buy mortgage lender Countrywide

Financial Corp. and Merrill have forced Bank of America, run since 2010 by

Chief Executive Brian Moynihan, to set aside more than $42 billion in

litigation expenses, payouts and reserves, according to company figures. The

funds are meant to absorb a litany of Merrill-related lawsuits and claims

from investors who say Countrywide wasn't honest about the quality of

mortgage-backed securities it issued before the crisis.

That total includes $1.6 billion taken in the third

quarter to help pay for the Merrill settlement announced Friday and a

landmark $8.5 billion agreement reached last year with a group of

high-profile mortgage-bond investors.

The company's shares lost more than half their

value between when Bank of America announced its late-2008 plan to purchase

Merrill Lynch and the date the deal closed 3½ months later, wiping out $70

billion in shareholder value. The shares have fallen further since then, and

investors who owned the shares won't be made whole by the settlement.

"We find it simply amazing the sheer magnitude of

value destruction over the years," said Sterne Agee in the note issued

Friday. And "the bill is surely set to increase" as the research firm

expects the bank to reach other legal settlements over the next 12 to 24

months. Bank of America is still engaged in a legal clash with bond insurer

MBIA Inc.,

MBI +3.91%

which has alleged that Countrywide wasn't honest about the quality of

mortgage-backed securities it issued before the financial crisis.

The move to buy Merrill over one weekend in

September 2008 was initially hailed as a rare piece of good news during a

week when much of Wall Street appeared to be teetering on the brink. It also

vaulted the Charlotte, N.C., lender to the top of the U.S. banking heap,

capping a goal pursued over two decades by Mr. Lewis and his predecessor,

Hugh McColl.

The Merrill deal, initially valued at $50 billion

in Bank of America stock, was the "deal of a lifetime," Mr. Lewis said on

the day it was announced.

But the agreement soon became a problem as analysts

questioned whether Mr. Lewis paid too much and Merrill's losses spiraled out

of control in the weeks before the deal closed. Investor fears stemming from

the financial crisis sent shares of Bank of America and other financial

companies into free fall, and the deal was worth roughly $19 billion at its

completion on Jan. 1, 2009.

Mr. Lewis and his top executives made the decision

not to say anything publicly about the mounting problems before shareholders

signed off on the merger—a decision that formed the basis of a number of

Merrill-related suits, including an action brought by the Securities and

Exchange Commission. The bank also didn't disclose that it sought $20

billion in U.S. aid to digest Merrill, or that the deal allowed Merrill to

award up to $5.8 billion in performance bonuses. When Bank of America

threatened to pull out of the deal because of the losses, then-Treasury

Secretary Henry Paulson told Mr. Lewis that current management would be

removed if the deal wasn't completed.

The legal scrutiny surrounding the Merrill

acquisition contributed to Mr. Lewis's decision to step down at the end of

2009. Mr. Lewis's lawyer declined to comment.

"Any way you slice it, $2.4 billion is a big

number," says Kevin LaCroix, a lawyer at RT ProExec, a firm that focuses on

management-liability issues.

Bank of America executives now say Merrill, unlike

Countrywide, has become a big profit contributor, while the company

continues to work to absorb massive losses in its mortgage division. The

divisions inherited from Merrill produced $31.9 billion in net income

between 2009 and 2011 and $164.4 billion in revenue. Bank of America's total

net income over the period was just $5.5 billion, on $326.8 billion in

revenue, reflecting in part the hefty losses tied to the Countrywide deal.

"I think it's clear that Merrill is a significant

positive any way you want to look at it," said spokesman Jerry Dubrowski.

The settlement doesn't end all Merrill-related

headaches. The New York attorney general's office still is pursuing a

separate civil fraud suit relating to the Merrill takeover that began under

former Attorney General Andrew Cuomo. Defendants in that case include the

bank, Mr. Lewis and former Chief Financial Officer Joe Price. A spokesman

for New York State Attorney General Eric Schneiderman declined to comment.

It isn't known how much all shareholders will

receive as a result of the Merrill settlement announced Friday. The amount

shareholders receive will ultimately depend on how long they held the shares

and how much they paid. Mr. Lewis, also a shareholder, won't receive a

payout because defendants in the suit are excluded from the class that the

court certified.

But because the decline in Bank of America stock

was so steep—the shares fell from $32 to $14 between Sept. 12, 2008, the day

before the Merrill acquisition was announced, and the Jan. 1, 2009,

closing—no shareholders can expect to recover their full losses.

Before the settlement was reached, a targeted

recovery for at least three million shareholders who were part of the class

was $2.52 a share, said a spokesman for Ohio Attorney General Mike DeWine.

The State Teachers Retirement System of Ohio and the Ohio Public Employees

Retirement System, which held between 18 million and 20 million shares, now

expect to recover $1.19 per share, or roughly $20 million.

Continued in article

CDO ---

http://en.wikipedia.org/wiki/Collateralized_debt_obligation

Countrywide Financial ---

http://en.wikipedia.org/wiki/Countrywide_Financial

Those Poisoned CDOs

"Bank of America Ordered to Unseal Documents in MBIA Case," by Dan Freed,

The Street, June 4, 2013 ---

http://www.thestreet.com/story/11804771/1/bank-of-america-ordered-to-unseal-documents-in-mbia-case.html

Update November 22, 2016

Treasury Secretary Hank

Paulson's Bank of America Extortion Scheme (Hustle) Finally Laid to Rest

From the CFO Journal's Morning Ledger

on November 23, 2016

Do the Hustle? Nope

The government’s Hustle

case against Bank of America Corp. is

finally dead. The case, in which the government accused the bank’s

Countrywide Financial Corp. unit of

churning out shoddy mortgage securities in the run-up to the financial

crisis, already was thrown out by a U.S. appeals court in May. The U.S.

attorney’s office in Manhattan, which had first brought the case in 2012,

then asked the appeals court to reconsider its decision, a request that was

denied.

Jensen Comment

A better word for "Hustle" is Treasury Department

"Extortion." When the economy collapsed in 2007 due to poisoned mortgages

BofA had no poisoned mortgages. Then Treasury Secretary Hank Paulson came

calling like an extortionist according to former BofS CEO Ken Lewis. Paulson

gave BofA no choice but to buy Countrywide Financial with its millions of

poisoned mortgages. The secret intent was to give Countrywide deeper pockets

so that the Federal Government could turn around a sue BofA billions for all

the financial crimes of Countrywide Financial.

There was never any doubt about the high crimes of

Countrywide Financial on the main streets of cities and towns across the

USA. Countrywide issued millions of mortgages to borrowers having no hope of

meeting their mortgage obligations.

It makes me feel good that Paulson finally got his just

dessert. I only wish he would be sued. As the former CEO of Goldman Sachs he

bailed out Goldman with milk and honey and pissed on BofA. Now he's retired

on his millions from Goldman and seemingly can't be touched for his

extortion crimes.

CDO ---

https://en.wikipedia.org/wiki/Collateralized_debt_obligation

"Goldman Reaches $5 Billion Settlement Over Mortgage-Backed Securities:

Pact marks largest settlement in history of Wall Street firm," by Justin

Baer and Chelsey Dulaney, The Wall Street Journal, January 14, 2016 ---

http://www.wsj.com/articles/goldman-reaches-5-billion-settlement-over-mortgage-backed-securities-1452808185?mod=djemCFO_h

Goldman Sachs Group Inc. agreed to the largest

regulatory penalty in its history, resolving U.S. and state claims stemming

from the Wall Street firm’s sale of mortgage bonds heading into the

financial crisis.

In settling with the Justice Department and a

collection of other state and federal entities for more than $5 billion,

Goldman will join a list of other big banks in moving past one of the

biggest, and most costly, legal headaches of the crisis era.

Goldman said litigation legal expenses stemming

from the accord would trim its fourth-quarter earnings by about $1.5

billion, after taxes. The firm is scheduled to report results Wednesday.

“We are pleased to have reached an agreement in

principle to resolve these matters,” Lloyd Blankfein, Goldman’s chief

executive, said in a statement.

Government officials previously won

multibillion-dollar settlements from J.P. Morgan Chase & Co., Bank of

America Corp. and Citigroup Inc. The probes examined how Wall Street sold

bonds tied to residential mortgages, and whether banks deceived investors by

misrepresenting the quality of underlying loans.

The government’s inquiry into Goldman related to

mortgage-backed securities the firm packaged and sold between 2005 and 2007,

the years when the housing market was soaring and investor demand for

related bonds was still strong.

Continued in article

New Rules

for CDOs

"Statement at Open Meeting: Asset-Backed Securities Disclosure and

Registration," by Commissioner Kara M. Stein, SEC, August 27, 2014 ---

http://www.sec.gov/News/PublicStmt/Detail/PublicStmt/1370542772431#.VBgvYBZS7rx

I begin my remarks by echoing others and commending the work of the team

that has been working on this rule, including Rolaine Bancroft, Hughes

Bates, Michelle Stasny, Kayla Florio, Heather Mackintosh, Silvia Pilkerton,

Robert Errett, Max Rumyantsev, and Kathy Hsu.

Heather and Sylvia have been working on the data tagging and preparing EDGAR

to accept this new data. This is no small endeavor.

I want to give a special thank you to Paula Dubberly, who retired last year

from the SEC and is in the audience today. She has been a champion for

investors through her leadership on asset-backed securities regulation from

the development of the initial Reg AB proposal through the rules that are

being considered today.

This rule is an important step forward in completing the mandated Dodd-Frank

Act rulemakings.[1]

The financial crisis revealed investors’ inability to actually assess pools

of loans that had been sliced and diced, sometimes multiple times, by being

securitized, re-securitized, or combined in a dizzying array of complex

financial instruments. The securitization market was at the center of the

financial crisis. While securitization structures provided liquidity to

nearly every sector in the U.S. economy, they also exposed investors to

significant and non-transparent risks due to poor lending practices and poor

disclosure practices.

As we now know, offering documents failed to provide timely and complete

information for investors to assess the underlying risks of the pool of

assets.[2]

Without sufficient and accurate loan level details, analysts and investors

could not gauge the quality of the loans – and without an ability to

distinguish the good from the bad, the secondary market collapsed.

Congress responded and required the Commission to promulgate rules to

address a number of weaknesses in the securitization process.[3]

Six years after the financial crisis, the securitization markets continue to

recover. While certain asset classes have rebounded, others continue to

struggle.

The rule the Commission issues today partially addresses the Congressional

mandate. In effect, today’s rules provide investors with better information

on what is inside the securitization package. The rules today do for

investors what food and drug labeling does for consumers – provide a list of

ingredients.

This rule also addresses certain critical flaws that became apparent in the

securitization process, including a dearth of quality information and

insufficient time to make informed assessments of the underlying

investments. This rule is an important step toward providing investors with

tools and data to better understand the underlying risks and appropriately

price the securities.

There are several important and laudable aspects of today’s rule that merit

specific mentioning.

First, the rule requires the underlying loan information to be standardized

and available in a tagged XML format to ensure maximum utility in analysis.[4]

As noted in the Commission’s 2010 Proxy Plumbing Release: “If issuers

provided reportable items in interactive data format, shareholders may be

able to more easily obtain information about issuers, compare information

across different issuers, and observe how issuer-specific information

changes over time as the same issuer continues to file in an interactive

format.”[5]

The same is true for underlying loan information. Investors can unlock the

value and efficiency that standardized, machine readable data allows.

Today’s rule also improves disclosures regarding the initial offering of

securities and significantly, for the first time, requires periodic updating

regarding the loans as they perform over time. This information will

provide a more nuanced and evolving picture of the underlying assets in a

portfolio to investors.

The rule also requires that the principal executive officer of the ABS

issuer certify that the information in the prospectus or report is

accurate. These kinds of certifications provide a key control to help

ensure more oversight and accountability.

As for the privacy concerns that prompted a re-proposal, the staff has

worked hard to balance investor needs for loan level data with concerns that

the data could lead to identification of individual borrowers. I believe

the rule achieves a workable balance between these two competing needs,

while still providing invaluable public disclosure.

Finally, I believe that the new disclosure rule will provide investors with

the necessary tools to see what is “under the hood” on auto loan

securitizations. In its latest report on consumer debt and credit, the

Federal Reserve Bank of New York noted a recent spike in subprime auto

lending. As the report shows, although consumer auto debt balances have

risen across the board, the real growth has been in riskier loans.[6]

The disclosure and reporting changes that the Commission is adopting today

will help investors see the quality of the loans in a portfolio and the

performance of those loans over time.

While today’s rules are an important step forward, more work needs to be

done regarding conflicts of interest. We now know that many firms who were

structuring securitizations before the financial crisis were also betting

against those same securitizations.

In April 2010, the Commission charged the U.S broker-dealer of a large

financial services firm for its role in failing to disclose that it allowed

a client to select assets for an investment portfolio while betting that the

portfolio would ultimately lose its value. Investors in the portfolio lost

more than $1 billion.[7]

In October 2011, the Commission sued the U.S broker-dealer of a large

financial services firm for among other things, selling investment products

tied to the housing market and then, for their own trading, betting that

those assets would lose money. In effect, the firm bet against the very

investors it had solicited. An experienced collateral manager commented

internally that a particular portfolio was “horrible.” While investors lost

virtually all of their investments in the portfolio, the firm pocketed over

$160 million from bets it made against the securitization it created.[8]

The Dodd-Frank Act directed the Commission to adopt rules prohibiting

placement agents, underwriters, and sponsors from engaging in a material

conflict of interest for one year following the closing of a securitization

transaction. Those rules were required to be issued by April 2011.[9]

The Commission initially proposed these rules in September 2011, and still

has not completed them.[10]

We need to complete these rules as soon as possible, hopefully, by the end

of this year. These rules will provide investors with additional confidence

that they are not being hoodwinked by those packaging and selling those

financial instruments.

Unfortunately, the Commission has put on hold its work to provide investors

with a software engine to aid in the calculation of waterfall models.

Although the final rule provides for a preliminary prospectus at least three

business days before the first sale, this is reduced from the proposal,

which provided for a five-day period. With only three days to conduct due

diligence and make an investment determination, such a software engine could

be an important and much needed tool for investors to use in analyzing the

flow of funds. Such waterfall models can help investors assess the cash

flows from the loan level data. We should return to this important

initiative to provide investors with the mathematical logic that forms the

basis for the narrative disclosure within the prospectus.

CDO ---

https://en.wikipedia.org/wiki/Collateralized_debt_obligation

From the CFO Journal's

Morning Ledger on March 22, 2016

Former Lehman CFO tells her side of the firm’s collapse

Erin Montella’s new memoir offers a unique perspective

on the events that led to the financial crisis. “Full Circle,” which was

released

Sunday

on Amazon.com, tells the story of how Ms. Montella rose to become the

highest-ranking woman on Wall Street in 2008, only to resign from the firm

six months after being named CFO. She accepted the position only after

becoming convinced she could make the role more important, “something close

to the CEO heir apparent.”

"JPMorgan to pay $1.42 billion cash to settle most Lehman claims," by

Jonatan Stemel, Reuters, January 25, 2016 ---

http://www.reuters.com/article/us-jpmorgan-lehman-idUSKCN0V4049

JPMorgan Chase & Co (JPM.N) will pay $1.42 billion

in cash to resolve most of a lawsuit accusing it of draining Lehman Brothers

Holdings Inc of critical liquidity in the final days before that investment

bank's September 2008 collapse.

The settlement was made public on Monday, and

requires approval by U.S. Bankruptcy Judge Shelley Chapman in Manhattan.

It resolves the bulk of an $8.6 billion lawsuit

accusing JPMorgan of exploiting its leverage as Lehman's main "clearing"

bank to siphon billions of dollars of collateral just before Lehman went

bankrupt on Sept. 15, 2008, triggering a global financial crisis.

Lehman's creditors charged that JPMorgan did not

need the collateral and extracted a windfall at their expense.

Monday's settlement also resolves Lehman's

challenges to JPMorgan's decision to close out thousands of derivatives

trades following the bankruptcy, court papers showed.

The accord would permit a further $1.496 billion to

be distributed to the creditors, including a separate $76 million deposit,

court papers showed.

Continued in article

"Goldman Reaches $5 Billion Settlement Over Mortgage-Backed Securities:

Pact marks largest settlement in history of Wall Street firm," by Justin

Baer and Chelsey Dulaney, The Wall Street Journal, January 14, 2016 ---

http://www.wsj.com/articles/goldman-reaches-5-billion-settlement-over-mortgage-backed-securities-1452808185?mod=djemCFO_h

Goldman Sachs Group Inc. agreed to the largest

regulatory penalty in its history, resolving U.S. and state claims stemming

from the Wall Street firm’s sale of mortgage bonds heading into the

financial crisis.

In settling with the Justice Department and a

collection of other state and federal entities for more than $5 billion,

Goldman will join a list of other big banks in moving past one of the

biggest, and most costly, legal headaches of the crisis era.

Goldman said litigation legal expenses stemming

from the accord would trim its fourth-quarter earnings by about $1.5

billion, after taxes. The firm is scheduled to report results Wednesday.

“We are pleased to have reached an agreement in

principle to resolve these matters,” Lloyd Blankfein, Goldman’s chief

executive, said in a statement.

Government officials previously won

multibillion-dollar settlements from J.P. Morgan Chase & Co., Bank of

America Corp. and Citigroup Inc. The probes examined how Wall Street sold

bonds tied to residential mortgages, and whether banks deceived investors by

misrepresenting the quality of underlying loans.

The government’s inquiry into Goldman related to

mortgage-backed securities the firm packaged and sold between 2005 and 2007,

the years when the housing market was soaring and investor demand for

related bonds was still strong.

Continued in article

New Rules

for CDOs

"Statement at Open Meeting: Asset-Backed Securities Disclosure and

Registration," by Commissioner Kara M. Stein, SEC, August 27, 2014 ---

http://www.sec.gov/News/PublicStmt/Detail/PublicStmt/1370542772431#.VBgvYBZS7rx

I begin my remarks by echoing others and commending the work of the team

that has been working on this rule, including Rolaine Bancroft, Hughes

Bates, Michelle Stasny, Kayla Florio, Heather Mackintosh, Silvia Pilkerton,

Robert Errett, Max Rumyantsev, and Kathy Hsu.

Heather and Sylvia have been working on the data tagging and preparing EDGAR

to accept this new data. This is no small endeavor.

I want to give a special thank you to Paula Dubberly, who retired last year

from the SEC and is in the audience today. She has been a champion for

investors through her leadership on asset-backed securities regulation from

the development of the initial Reg AB proposal through the rules that are

being considered today.

This rule is an important step forward in completing the mandated Dodd-Frank

Act rulemakings.[1]

The financial crisis revealed investors’ inability to actually assess pools

of loans that had been sliced and diced, sometimes multiple times, by being

securitized, re-securitized, or combined in a dizzying array of complex

financial instruments. The securitization market was at the center of the

financial crisis. While securitization structures provided liquidity to

nearly every sector in the U.S. economy, they also exposed investors to

significant and non-transparent risks due to poor lending practices and poor

disclosure practices.

As we now know, offering documents failed to provide timely and complete

information for investors to assess the underlying risks of the pool of

assets.[2]

Without sufficient and accurate loan level details, analysts and investors

could not gauge the quality of the loans – and without an ability to

distinguish the good from the bad, the secondary market collapsed.

Congress responded and required the Commission to promulgate rules to

address a number of weaknesses in the securitization process.[3]

Six years after the financial crisis, the securitization markets continue to

recover. While certain asset classes have rebounded, others continue to

struggle.

The rule the Commission issues today partially addresses the Congressional

mandate. In effect, today’s rules provide investors with better information

on what is inside the securitization package. The rules today do for

investors what food and drug labeling does for consumers – provide a list of

ingredients.

This rule also addresses certain critical flaws that became apparent in the

securitization process, including a dearth of quality information and

insufficient time to make informed assessments of the underlying

investments. This rule is an important step toward providing investors with

tools and data to better understand the underlying risks and appropriately

price the securities.

There are several important and laudable aspects of today’s rule that merit

specific mentioning.

First, the rule requires the underlying loan information to be standardized

and available in a tagged XML format to ensure maximum utility in analysis.[4]

As noted in the Commission’s 2010 Proxy Plumbing Release: “If issuers

provided reportable items in interactive data format, shareholders may be

able to more easily obtain information about issuers, compare information

across different issuers, and observe how issuer-specific information

changes over time as the same issuer continues to file in an interactive

format.”[5]

The same is true for underlying loan information. Investors can unlock the

value and efficiency that standardized, machine readable data allows.

Today’s rule also improves disclosures regarding the initial offering of

securities and significantly, for the first time, requires periodic updating

regarding the loans as they perform over time. This information will

provide a more nuanced and evolving picture of the underlying assets in a

portfolio to investors.

The rule also requires that the principal executive officer of the ABS

issuer certify that the information in the prospectus or report is

accurate. These kinds of certifications provide a key control to help

ensure more oversight and accountability.

As for the privacy concerns that prompted a re-proposal, the staff has

worked hard to balance investor needs for loan level data with concerns that

the data could lead to identification of individual borrowers. I believe

the rule achieves a workable balance between these two competing needs,

while still providing invaluable public disclosure.

Finally, I believe that the new disclosure rule will provide investors with

the necessary tools to see what is “under the hood” on auto loan

securitizations. In its latest report on consumer debt and credit, the

Federal Reserve Bank of New York noted a recent spike in subprime auto

lending. As the report shows, although consumer auto debt balances have

risen across the board, the real growth has been in riskier loans.[6]

The disclosure and reporting changes that the Commission is adopting today

will help investors see the quality of the loans in a portfolio and the

performance of those loans over time.

While today’s rules are an important step forward, more work needs to be

done regarding conflicts of interest. We now know that many firms who were

structuring securitizations before the financial crisis were also betting

against those same securitizations.

In April 2010, the Commission charged the U.S broker-dealer of a large

financial services firm for its role in failing to disclose that it allowed

a client to select assets for an investment portfolio while betting that the

portfolio would ultimately lose its value. Investors in the portfolio lost

more than $1 billion.[7]

In October 2011, the Commission sued the U.S broker-dealer of a large

financial services firm for among other things, selling investment products

tied to the housing market and then, for their own trading, betting that

those assets would lose money. In effect, the firm bet against the very

investors it had solicited. An experienced collateral manager commented

internally that a particular portfolio was “horrible.” While investors lost

virtually all of their investments in the portfolio, the firm pocketed over

$160 million from bets it made against the securitization it created.[8]

The Dodd-Frank Act directed the Commission to adopt rules prohibiting

placement agents, underwriters, and sponsors from engaging in a material

conflict of interest for one year following the closing of a securitization

transaction. Those rules were required to be issued by April 2011.[9]

The Commission initially proposed these rules in September 2011, and still

has not completed them.[10]

We need to complete these rules as soon as possible, hopefully, by the end

of this year. These rules will provide investors with additional confidence

that they are not being hoodwinked by those packaging and selling those

financial instruments.

Unfortunately, the Commission has put on hold its work to provide investors

with a software engine to aid in the calculation of waterfall models.

Although the final rule provides for a preliminary prospectus at least three

business days before the first sale, this is reduced from the proposal,

which provided for a five-day period. With only three days to conduct due

diligence and make an investment determination, such a software engine could

be an important and much needed tool for investors to use in analyzing the

flow of funds. Such waterfall models can help investors assess the cash

flows from the loan level data. We should return to this important

initiative to provide investors with the mathematical logic that forms the

basis for the narrative disclosure within the prospectus.

Bob Jensen's threads on CDO accounting scandals and new rules ---

http://faculty.trinity.edu/rjensen/theory02.htm#CDO

Breaking the Bank Frontline

Video

In Breaking the Bank, FRONTLINE producer Michael Kirk

(Inside the Meltdown, Bush’s War) draws on a rare combination of high-profile

interviews with key players Ken Lewis and former Merrill Lynch CEO John Thain to

reveal the story of two banks at the heart of the financial crisis, the rocky

merger, and the government’s new role in taking over — some call it

“nationalizing” — the American banking system.

Simoleon Sense, September 18,

2009 ---

http://www.simoleonsense.com/video-frontline-breaking-the-bank/

Bob Jensen's threads on the banking bailout ---

http://faculty.trinity.edu/rjensen/2008Bailout.htm

Update November 23, 2016

Treasury Secretary Hank Paulson's Bank of America Extortion Scheme (Hustle)

Finally Laid to Rest

From the CFO Journal's Morning Ledger

on November 23, 2016

Do the Hustle? Nope

The government’s Hustle

case against Bank of America Corp. is

finally dead. The case, in which the government accused the bank’s

Countrywide Financial Corp. unit of

churning out shoddy mortgage securities in the run-up to the financial

crisis, already was thrown out by a U.S. appeals court in May. The U.S.

attorney’s office in Manhattan, which had first brought the case in 2012,

then asked the appeals court to reconsider its decision, a request that was

denied.

Jensen Comment

A better word for "Hustle" is Treasury Department

"Extortion." When the economy collapsed in 2007 due to poisoned mortgages

BofA had no poisoned mortgages. Then Treasury Secretary Hank Paulson came

calling like an extortionist according to former BofS CEO Ken Lewis. Paulson

gave BofA no choice but to buy Countrywide Financial with its millions of

poisoned mortgages. The secret intent was to give Countrywide deeper pockets

so that the Federal Government could turn around a sue BofA billions for all

the financial crimes of Countrywide Financial.

There was never any doubt about the high crimes of

Countrywide Financial on the main streets of cities and towns across the

USA. Countrywide issued millions of mortgages to borrowers having no hope of

meeting their mortgage obligations.

It makes me feel good that Paulson finally got his just

dessert. I only wish he would be sued. As the former CEO of Goldman Sachs he

bailed out Goldman with milk and honey and pissed on BofA. Now he's retired

on his millions from Goldman and seemingly can't be touched for his

extortion crimes.

U.S. loan relief program

may have made things worse

The Obama administration’s $75 billion program to

protect homeowners from foreclosure has been widely pronounced a disappointment,

and some economists and real estate experts now contend it has done more harm

than good. Since President Obama announced the program in February, it has

lowered mortgage payments on a trial basis for hundreds of thousands of people

but has largely failed to provide permanent relief. Critics increasingly argue

that the program, Making Home Affordable, has raised false hopes among people

who simply cannot afford their homes.

Peter S. Goodman, "U.S. loan program may have made things worse," MSNBC,

January 1, 2010 ---

http://www.msnbc.msn.com/id/34663078/ns/business-the_new_york_times/

Selling the debt in the left pocket to the right pocket: The Fed is

all smoke and mirrors

"Fed Is Buying 61 Percent of U.S. Government Debt," by Bob Adelmann, The New

American, March 29, 2012

http://thenewamerican.com/economy/commentary-mainmenu-43/11357-fed-is-buying-61-of-us-government-debt

In his attempt to explode the myth that there is

unlimited demand for U.S. government debt, former Treasury official Lawrence

Goodman

explained that there

is high perceived demand because the Federal Reserve is doing most

of the buying.

Wrote Goodman,

Last year the Fed

purchased a stunning 61% of the total net Treasury issuance, up from

negligible amounts prior to the 2008 financial crisis.

This not only creates

the false impression of limitless demand for U.S. debt but also blunts any

sense of urgency to reduce supersized budget deficits.

What about Japan and China? Aren’t they the major

purchasers of U.S. debt? Not any more, notes Goodman. Foreign purchases of

U.S. debt dropped to less than 2 percent of GDP (Gross Domestic Product)

from almost 6 percent just three years ago. And private sector investors —

banks, money market and bond mutual funds, individuals and corporations —

have cut their buying way back as well, to less than 1 percent of GDP, down

from 6 percent. This serves to hide the fact that the government can’t find

outside buyers willing to accept rates of return that are below the

inflation rate (“negative interest”) given the precarious financial

condition of the government. It also hides the impact of $1.3 trillion

deficits from the public who would likely get much more concerned if real,

true market rates of interest were being demanded for purchasing U.S. debt,

as such higher rates would increase the deficit even further. Finally it

takes pressure off Congress to “do something” because there is no public

clamor over the matter, at least for the moment.

One of those promoting the myth that buyers of U.S.

debt must exist because interest rates are so low is none other than one of

those recently seated at the Federal Reserve’s Open Market Committee table,

Alan

Blinder. Now a professor of economics at Princeton

University, Blinder was vice chairman of the Fed in the mid-nineties and

should know all about the Fed’s manipulations and machinations in the money

markets. Apparently not.

On January 19 Blinder

wrote in the Wall Street Journal that

Strange as it may seem

with trillion-dollar-plus deficits, the U.S. government doesn’t have a

short-run borrowing problem at all. On the contrary, investors all over the

world are clamoring to lend us money at negative real interest rates.

In purchasing power

terms, they are paying the U.S. government to borrow their money!

Blinder

repeated the error in front of the Senate Banking

Committee just one week later: "In fact, world financial markets are eager

to lend the United States government vast amounts at negative real interest

rates. That means that, in purchasing power terms, they are paying us to

borrow their money!"

Aggressive promotion of a myth never makes it a

fact. All it does is hide, for a period, the reality that the world isn’t

willing to lend to the United States at negative interest rates. This places

the burden on the Fed to make the myth appear real by expanding its own

balance sheet and gobbling up U.S. debt.

There are going to be consequences. As Goodman put

it,

The failure by officials

to normalize conditions in the U.S. Treasury market and curtail ballooning

deficits puts the U.S. economy and markets at risk for a sharp

correction…. [Emphasis added.]

In other words, budget

deficits often take years to build or reduce, while financial markets react

rapidly and often unexpectedly to deficit spending and debt.

The

recent

release by the Congressional Budget Office (CBO)

of future inflation expectations provides little assurance either as it

mimics the line that inflation will stay low for the foreseeable future: "In

CBO’s forecast, the price index for personal consumption expenditures

increases by just 1.2 percent in 2012 and 1.3 percent in 2013."

With the Fed continuing to buy U.S. government

debt, which keeps interest rates artificially low, when will reality set in?

Amity Shlaes has the answer.

Writing in Bloomberg last week, Shlaes explains:

The thing about [price]

inflation is that it comes out of nowhere and hits you….

[It] has happened to us

before. In World War I … the CPI [Consumer Price Index] went from 1 percent

for 1915 to 7 percent in 1916 and 17 percent in 1917….

In 1945, all seemed

well. Inflation was at 2 percent, at least officially. Within two years that

level hit 14 percent.

All appeared calm in

1972, too, before inflation jumped to 11 percent by 1974 and stayed high for

the rest of the decade….

One thing is clear:

pretty soon, we’ll all be in deep water.

Doug Casey agrees: “Don’t think there are no

consequences to our unwise fiscal and monetary course; a potentially ugly

tipping point is more likely than not at some point.”

Coninued in article

I don't want to make this statement of fact seem political.

It applies no matter what political side is in power!

The Science of Macroeconomics is quite literally blameless.

If the economy improves and unemployment drops,

Obama can take credit. If it fails to improve and unemployment rises, though, he

can say he averted an even worse showing. Republicans will take the opposite

tack—attributing any improvement to the natural resilience of the economy and

blaming the administration if things get worse. And neither side will really

know who's right. I have long been a believer in the value of economics in

understanding the world. But the chief effect of the current crisis is to raise

the possibility that economists—at least those macroeconomists, who study the

broad economy—don't have a blessed clue.

"Baffled by the Economy: Why being a macroeconomist means

never having to say you're sorry," by Steve Chapman, Reason Magazine,

June 11, 2009 ---

http://www.reason.com/news/show/134059.html

The budget should be balanced, the Treasury

should be refilled, public debt should be reduced, the arrogance of officialdom

should be tempered and controlled, and the assistance to foreign lands should be

curtailed lest Rome become bankrupt. People must again learn to work, instead of

living on public assistance.

Taylor Caldwell, A Pillar of Iron

(wrongly attributed to

Cicero in 55 B.C.)

Five Speaker Videos from the Stanford Graduate School of Business (on the

economic crisis and leadership) [Scroll Down]

Top 5 Speaker Videos for 2009 ---

http://www.gsb.stanford.edu/news/top-videos.html?cmpid=alumni&source=gsbtoday

Great PBS Video on the Crash of 1929 ---

http://www.pbs.org/wgbh/americanexperience/crash/

Yale School of Management Cosponsors NYC Roundtable Discussion on the

Financial Crisis (Full Video Now Available)

http://mba.yale.edu/news_events/CMS/Articles/6608.shtml

Collateralized Debt Obligation ---

http://en.wikipedia.org/wiki/Collateralized_debt_obligation

"CDOs Are Back: Will They Lead to Another Financial Crisis?"

Knowledge@wharton, April 10, 2013 ---

http://knowledge.wharton.upenn.edu/article.cfm?articleid=3230

Can the 2008 investment banking failure be traced to a math error?

Recipe for Disaster: The Formula That Killed Wall Street ---

http://www.wired.com/techbiz/it/magazine/17-03/wp_quant?currentPage=all

Link forwarded by Jim Mahar ---

http://financeprofessorblog.blogspot.com/2009/03/recipe-for-disaster-formula-that-killed.html

Some highlights:

"For five years, Li's formula, known as a

Gaussian copula function, looked like an unambiguously positive

breakthrough, a piece of financial technology that allowed hugely

complex risks to be modeled with more ease and accuracy than ever

before. With his brilliant spark of mathematical legerdemain, Li made it

possible for traders to sell vast quantities of new securities,

expanding financial markets to unimaginable levels.

His method was adopted by everybody from bond

investors and Wall Street banks to ratings agencies and regulators. And

it became so deeply entrenched—and was making people so much money—that

warnings about its limitations were largely ignored.

Then the model fell apart." The article goes on to show that correlations

are at the heart of the problem.